Business, 16.03.2020 21:10 queenb1416

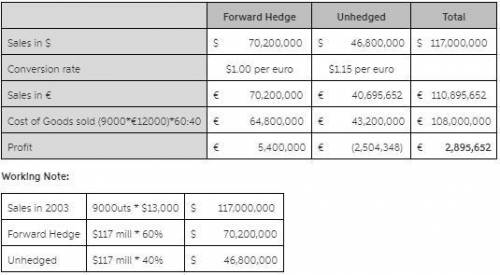

Jetta production cost in 2002 and 2003 was 12,000 Euro per Jetta. Jettas were sold in US at $13,000 in 2002 and 2003. Forward hedge exchange rate was 1 $/Euro in 2003. The market exchange rate was 1.15 $/Euro (i. e. rate without hedge) in 2003. If 9,000 Jetta were sold in US, in 2003, by 60% forward hedge and 40% not hedged. What would be profits or loss from sales of 9,000 Jetta in US?

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

Why has the free enterprise system been modified to include some government intervention?

Answers: 1

Business, 22.06.2019 16:20

The assumptions of the production order quantity model are met in a situation where annual demand is 3650 units, setup cost is $50, holding cost is $12 per unit per year, the daily demand rate is 10 and the daily production rate is 100. the production order quantity for this problem is approximately:

Answers: 1

Business, 22.06.2019 16:40

Differentiate between the trait, behavioral, and results-based performance appraisal systems, providing an example where each would be most applicable.

Answers: 1

Business, 23.06.2019 08:10

To determine her power usage, samantha divides up her day into three parts: morning, afternoon, and evening. she then measures her power usage at 3 randomly selected times during each part of the day.

Answers: 2

You know the right answer?

Jetta production cost in 2002 and 2003 was 12,000 Euro per Jetta. Jettas were sold in US at $13,000...

Questions

Geography, 13.08.2021 01:00

Mathematics, 13.08.2021 01:00

Biology, 13.08.2021 01:00

Mathematics, 13.08.2021 01:00

Mathematics, 13.08.2021 01:00

Mathematics, 13.08.2021 01:00