Business, 16.03.2020 23:32 rennytheraccoon

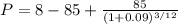

The common stock of the P. U.T. T. Corporation has been trading in a narrow price range for the past month, and you are convinced it is going to break far out of that range in the next 3 months. You do not know whether it will go up or down, however. The current price of the stock is $85 per share, and the price of a 3-month call option at an exercise price of $85 is $8.00. a. If the risk-free interest rate is 9% per year, what must be the price of a 3-month put option on P. U.T. T. stock at an exercise price of $85? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 23.06.2019 12:20

Sarah wants to use a suitable forecasting method to forecast the sales of umbrellas at her shop. she knows that her sales are seasonal. which technique of sales forecasting would you suggest to her?

Answers: 3

Business, 23.06.2019 19:00

Boncidio inc., a cell phone manufacturer, introduced a new cell phone model. 85 percent of this phone is made from biodegradable materials. this product attracts customers who give importance to using environment-friendly products in their daily lives. in the context of social responsibility and technology, boncidio best illustrates

Answers: 2

Business, 23.06.2019 21:00

If someone is considered to be bearish where do they think the stock market is heading

Answers: 1

You know the right answer?

The common stock of the P. U.T. T. Corporation has been trading in a narrow price range for the past...

Questions

Mathematics, 08.10.2019 21:30

History, 08.10.2019 21:30

Health, 08.10.2019 21:30

Health, 08.10.2019 21:30

History, 08.10.2019 21:30

Mathematics, 08.10.2019 21:30

English, 08.10.2019 21:30

Mathematics, 08.10.2019 21:30

Mathematics, 08.10.2019 21:30

Mathematics, 08.10.2019 21:30

is $85

is $85