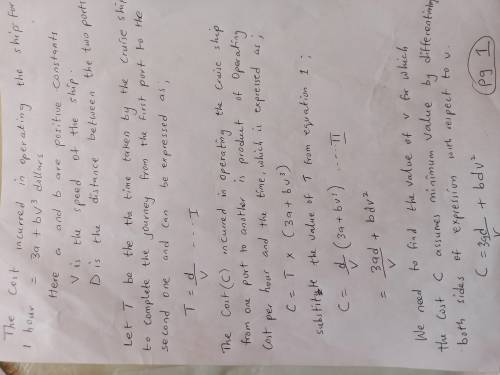

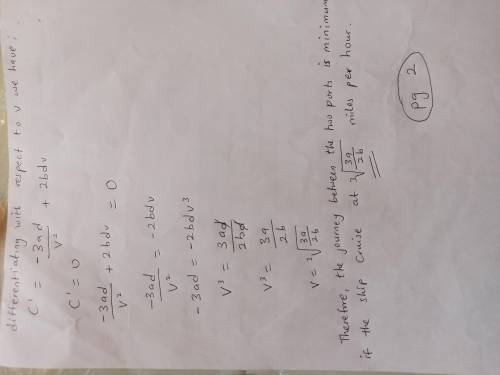

Suppose the cost per hour incurred in operating a cruise ship is 3a + bv3 dollars per hour, where a and b are positive constants and v is the ship's speed in miles per hour. At what speed (in miles per hour) should the ship be operated between two ports, at a distance D miles apart, to minimize the cost? (Hint: Minimize the cost, not the cost per hour.)

Answers: 2

Another question on Business

Business, 22.06.2019 20:20

Tl & co. is following a related-linked diversification strategy, and soar inc. is following a related-constrained diversification strategy. how do the two firms differ from each other? a. soar inc. generates 70 percent of its revenues from its primary business, while tl & co. generates only 10 percent of its revenues from its primary business. b. soar inc. pursues a backward diversification strategy, while tl & co. pursues a forward diversification strategy. c. tl & co. will share fewer common competencies and resources between its various businesses when compared to soar inc. d. tl & co. pursues a differentiation strategy, and soar inc. pursues a cost-leadership strategy, to gain a competitive advantage.

Answers: 3

Business, 22.06.2019 23:00

Which of the following is true of website content? it should be refreshed periodically to keep customers coming back. once the content has been written and proofread it shouldn't be changed. grammatical errors are not a problem because the customer visits the site to purchase a product, not check the site's grammar. it should be limited to text and shouldn't include multimedia.

Answers: 1

Business, 23.06.2019 02:50

Kandon enterprises, inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. both divisions are considered separate components as defined by generally accepted accounting principles. the horse division has been unprofitable, and on november 15, 2018, kandon adopted a formal plan to sell the division. the sale was completed on april 30, 2019. at december 31, 2018, the component was considered held for sale. on december 31, 2018, the company’s fiscal year-end, the book value of the assets of the horse division was $415,000. on that date, the fair value of the assets, less costs to sell, was $350,000. the before-tax loss from operations of the division for the year was $290,000. the company’s effective tax rate is 40%. the after-tax income from continuing operations for 2018 was $550,000. required: 1. prepare a partial income statement for 2018 beginning with income from continuing operations. ignore eps disclosures. 2. prepare a partial income statement for 2018 beginning with income from continuing operations. assuming that the estimated net fair value of the horse division’s assets was $700,000, instead of $350,000. ignore eps disclosures.

Answers: 2

Business, 23.06.2019 09:50

If art has a 7/1 arm, how long will the fixed interest rate be applied to his loan?

Answers: 3

You know the right answer?

Suppose the cost per hour incurred in operating a cruise ship is 3a + bv3 dollars per hour, where a...

Questions

Mathematics, 18.03.2021 01:00

Mathematics, 18.03.2021 01:00

Mathematics, 18.03.2021 01:00

Social Studies, 18.03.2021 01:00

History, 18.03.2021 01:00

Social Studies, 18.03.2021 01:00

Mathematics, 18.03.2021 01:00

Health, 18.03.2021 01:00

Mathematics, 18.03.2021 01:00

English, 18.03.2021 01:00

dollars per hour, where a and b are positive constants and v is the ship's speed in miles per hour. At what speed (in miles per hour) should the ship be operated between two ports, at a distance D miles apart, to minimize the cost? (Hint: Minimize the cost, not the cost per hour.)

dollars per hour, where a and b are positive constants and v is the ship's speed in miles per hour. At what speed (in miles per hour) should the ship be operated between two ports, at a distance D miles apart, to minimize the cost? (Hint: Minimize the cost, not the cost per hour.)![\sqrt[3]{\frac{3a}{2b} }](/tpl/images/0549/6790/86c51.png)