Business, 17.03.2020 00:28 winterchadrick

Consider an economy with 500 people in the labor force. At the beginning of every month, 5 people lose their jobs and remain unemployed for exactly one month; one month later, they find new jobs and become employed. In addition, on January 1 of each year, 20 people lose their jobs and remain unemployed for six months before finding new jobs. Finally, on July 1 of each year, 20 people lose their jobs and remain unemployed for six months before finding new jobs.

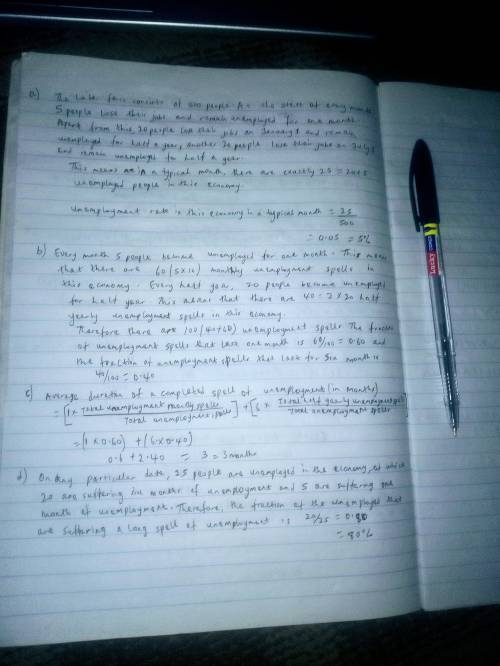

a. What is the unemployment rate in this economy in a typical month?

b. What fraction of unemployment spells lasts for one month? What fraction lasts for six months?

c. What is the average duration of a completed spell of unemployment?

d. On any particular date, what fraction of the unemployed are suffering a long spell (six months) of unemployment?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

What is the most important type of decision that the financial manager makes?

Answers: 2

Business, 22.06.2019 01:30

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 07:30

What is the relationship between the national response framework and the national incident management system (nims)? a. the national response framework replaces the nims, which is now obsolete. b. the response protocols and structures described in the national response framework align with the nims, and all nims components support response. c. the nims relates to local, state, and territorial operations, whereas the nrf relates strictly to federal operations. d. the nims and the national response framework cover different aspects of incident management—the nims is focused on tactical planning, and the national response framework is focused on coordination.

Answers: 3

Business, 22.06.2019 11:40

The following pertains to smoke, inc.’s investment in debt securities: on december 31, year 3, smoke reclassified a security acquired during the year for $70,000. it had a $50,000 fair value when it was reclassified from trading to available-for-sale. an available-for-sale security costing $75,000, written down to $30,000 in year 2 because of an other-than-temporary impairment of fair value, had a $60,000 fair value on december 31, year 3. what is the net effect of the above items on smoke’s net income for the year ended december 31, year 3?

Answers: 3

You know the right answer?

Consider an economy with 500 people in the labor force. At the beginning of every month, 5 people lo...

Questions

English, 20.09.2020 15:01

History, 20.09.2020 15:01

History, 20.09.2020 15:01

Computers and Technology, 20.09.2020 15:01

Mathematics, 20.09.2020 15:01

Mathematics, 20.09.2020 15:01

Chemistry, 20.09.2020 15:01

History, 20.09.2020 15:01

Social Studies, 20.09.2020 15:01

Spanish, 20.09.2020 15:01

Mathematics, 20.09.2020 15:01