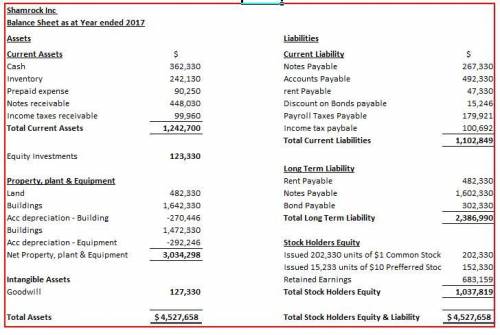

Presented below are a number of balance sheet items for Shamrock, Inc., for the current year, 2017.

Goodwill $127,330 Accumulated Depreciation-Equipment $292,246

Payroll Taxes Payable 179,921 Inventory 242,130

Bonds payable 302,330 Rent payable (short-term) 47,330

Discount on bonds payable 15,246 Income taxes payable 100,692

Cash 362,330 Rent payable (long-term) 482,330

Land 482,330 Common stock, $1 par value 202,330

Notes receivable 448,030 Preferred stock, $10 par value 152,330

Notes payable (to banks) 267,330 Prepaid expenses 90,250

Accounts payable 492,330 Equipment 1,472,330

Retained earnings ? Equity investments (trading) 123,330

Income taxes receivable 99,960 Accumulated Depreciation-Buildings 270,446

Notes payable (long-term) 1,602,330 Buildings 1,642,330

Required:

Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and preferred stock authorized was 20,000 shares. Assume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of equity investments (trading) are the same. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Building and Equipment.)

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 11:00

The following transactions occurred during july: received $1,000 cash for services provided to a customer during july. received $4,000 cash investment from bob johnson, the owner of the business received $850 from a customer in partial payment of his account receivable which arose from sales in june. provided services to a customer on credit, $475. borrowed $7,000 from the bank by signing a promissory note. received $1,350 cash from a customer for services to be rendered next year. what was the amount of revenue for july?

Answers: 1

Business, 23.06.2019 02:00

Which type of unemployment would increase if workers lost their jobs because their positions were replaced by an automated process? a) cyclical b) frictional c) international d) structural

Answers: 1

You know the right answer?

Presented below are a number of balance sheet items for Shamrock, Inc., for the current year, 2017.<...

Questions

Mathematics, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00

English, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00

Mathematics, 01.09.2021 01:00