Business, 17.03.2020 03:26 rebeccatrentbu7018

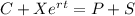

The common stock of the C. A.L. L. Corporation has been trading in a narrow range around $125 per share for months, and you believe it is going to stay in that range for the next 6 months. The price of a 6-month put option with an exercise price of $125 is $10.50. a. If the risk-free interest rate is 5% per year, what must be the price of a 6-month call option on C. A.L. L. stock at an exercise price of $125 if it is at the money? (The stock pays no dividends.

Answers: 3

Another question on Business

Business, 22.06.2019 14:00

Your dormitory, griffingate, has appointed you central banker of its economy, which deals in the currency of wizcoins. assume that the velocity of wizcoins in griffingate is constant at 10,000 transactions per year. right now, real gdp is 1,000 wizcoins, and there are 2,000 wizcoins in existence.

Answers: 2

Business, 22.06.2019 16:00

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

You know the right answer?

The common stock of the C. A.L. L. Corporation has been trading in a narrow range around $125 per sh...

Questions

Biology, 26.03.2021 18:10

Mathematics, 26.03.2021 18:10

History, 26.03.2021 18:10

English, 26.03.2021 18:10

Mathematics, 26.03.2021 18:10

Mathematics, 26.03.2021 18:10