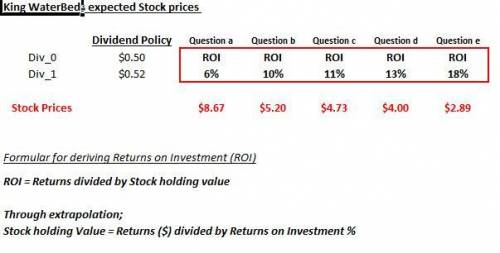

King Waterbeds has an annual cash dividend policy that raises the dividend each year by 44%. The most recent dividend, Div 0Div0, was $ 0.50$0.50 per share. What is the stock's price if a. an investor wants a return of 66%? b. an investor wants a return of 1010%? c. an investor wants a return of 1111%? d. an investor wants a return of 1313%? e. an investor wants a return of 1818%? a. What is the stock's price if an investor wants a return of 66%?

Answers: 1

Another question on Business

Business, 21.06.2019 17:00

What are ways individuals may reduce their total education and training costs?

Answers: 3

Business, 21.06.2019 22:10

There are more than two types of bachelors’ degrees true or false?

Answers: 1

Business, 22.06.2019 14:30

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

You know the right answer?

King Waterbeds has an annual cash dividend policy that raises the dividend each year by 44%. The mos...

Questions

Mathematics, 06.01.2021 20:30

English, 06.01.2021 20:30

Arts, 06.01.2021 20:30

Mathematics, 06.01.2021 20:30

Mathematics, 06.01.2021 20:30

Mathematics, 06.01.2021 20:30

English, 06.01.2021 20:30

English, 06.01.2021 20:30

History, 06.01.2021 20:30

Chemistry, 06.01.2021 20:30