Business, 18.03.2020 17:03 glocurlsprinces

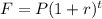

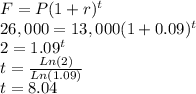

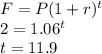

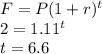

Manuel Rios wishes to determine how long it will take an initial deposit of $13 comma 000 to double. a. If Manuel earns 9% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 6% annual interest? c. How long will it take if he can earn 11% annual interest? d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 04:40

Select the correct text in the passage.which sentences in the given passage explains the limitations of monetary policies? monetary policies - limitationsmonetary policies are set by the central bank to bring about growth in the economy.de can be achieved these policiesw at anden i sca poit would be fair to say that changes in the economy cannot be brought about instantly by monetary po des.monetary policy can only influence not control, economic growththe monetary policy makers do work on sining the perfect balance between demand and supply of money in the economy

Answers: 3

Business, 22.06.2019 11:30

When the amount for land is 36,000 and the amount paid for expenses is 10,000, the balance of total asset is

Answers: 2

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

You know the right answer?

Manuel Rios wishes to determine how long it will take an initial deposit of $13 comma 000 to double....

Questions

Computers and Technology, 23.01.2022 03:40

English, 23.01.2022 03:40

Mathematics, 23.01.2022 03:40

Mathematics, 23.01.2022 03:40

Mathematics, 23.01.2022 03:40

Engineering, 23.01.2022 03:50

Mathematics, 23.01.2022 03:50

English, 23.01.2022 03:50

Mathematics, 23.01.2022 03:50

Mathematics, 23.01.2022 03:50

Biology, 23.01.2022 03:50

Social Studies, 23.01.2022 03:50