Business, 19.03.2020 04:56 queenkimm26

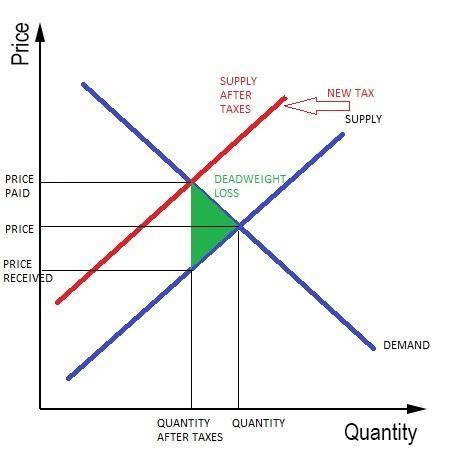

When a tax on a good is enacted, a. buyers and sellers share the burden of the tax regardless of whether the tax is levied on buyers or on sellers. b. buyers always bear the full burden of the tax. c. sellers always bear the full burden of the tax. d. sellers bear the full burden of the tax if the tax is levied on them; buyers bear the full burden of the tax if the tax is levied on them

Answers: 1

Another question on Business

Business, 22.06.2019 04:00

Don’t give me to many notifications because it will cause you to lose alot of points

Answers: 1

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 20:00

Double corporation acquired all of the common stock of simple company for

Answers: 1

Business, 22.06.2019 20:30

Exercise 7-7 martinez company reports the following financial information before adjustments. dr. cr. accounts receivable $168,900 allowance for doubtful accounts $3,200 sales revenue (all on credit) 849,300 sales returns and allowances 50,440 prepare the journal entry to record bad debt expense assuming martinez company estimates bad debts at (a) 4% of accounts receivable and (b) 4% of accounts receivable but allowance for doubtful accounts had a $1,550 debit balance. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 3

You know the right answer?

When a tax on a good is enacted, a. buyers and sellers share the burden of the tax regardless of whe...

Questions

History, 14.12.2021 21:30

History, 14.12.2021 21:30

Mathematics, 14.12.2021 21:30

Mathematics, 14.12.2021 21:30

Physics, 14.12.2021 21:30

Arts, 14.12.2021 21:30

Arts, 14.12.2021 21:30