Business, 19.03.2020 06:18 lannor6586

Companies frequently need to raise money to expand. To do this, corporations often issue corporate securities—stocks and bonds. But a security is simply a piece of paper; it has no intrinsic value. Consequently, without securities regulations, corporations could easily commit fraud by issuing large numbers of securities and then refusing to repay them. Thus, the government heavily regulates securities issuance and trading.

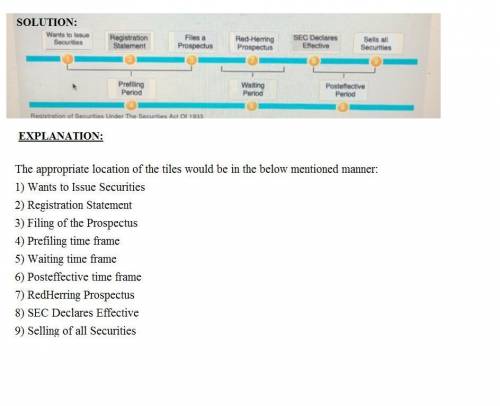

Read the titles below representing different steps in the registration process. Then draw each step on a timeline to the appropriate location.

Registration Statement

Prefiling Period

Red-Herring Prospectus

Files a Prospectus

Waiting Period

SEC Declares Effective

Sells all Securities

Wants to Issue Securities

Posteffective Period

Registration of Securities Under The Securities Act Of 1933

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Net income and owner's equity for four businesses four different proprietorships, jupiter, mars, saturn, and venus, show the same balance sheet data at the beginning and end of a year. these data, exclusive of the amount of owner's equity, are summarized as follows: total assets total liabilities beginning of the year $550,000 $215,000 end of the year 844,000 320,000 on the basis of the preceding data and the following additional information for the year, determine the net income (or loss) of each company for the year. (hint: first determine the amount of increase or decrease in owner's equity during the year.) jupiter: the owner had made no additional investments in the business and had made no withdrawals from the business. mars: the owner had made no additional investments in the business but had withdrawn $36,000. saturn: the owner had made an additional investment of $60,000 but had made no withdrawals. venus: the owner had made an additional investment of $60,000 and had withdrawn $36,000. jupiter net income $ mars net income $ saturn net income $ venus net income $

Answers: 3

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 16:20

There are three factors that can affect the shape of the treasury yield curve (r* t , ip t , and mrp t ) and five factors that can affect the shape of the corporate yield curve (r* t , ip t , mrp t , drp t , and lp t ). the yield curve reflects the aggregation of the impacts from these factors. suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the us treasury yield curve can take. check all that apply.a. downward-sloping yield curveb. upward-sloping yield curvec. inverted yield curve

Answers: 1

You know the right answer?

Companies frequently need to raise money to expand. To do this, corporations often issue corporate s...

Questions

Mathematics, 10.03.2020 07:20

Spanish, 10.03.2020 07:20

Mathematics, 10.03.2020 07:20

English, 10.03.2020 07:21

Mathematics, 10.03.2020 07:21

Computers and Technology, 10.03.2020 07:21