Business, 19.03.2020 10:38 tusharchandler124

Presented below is a list of accounts in alphabetical order.

Accounts Receivable

Inventory-Ending

Accumulated Depreciation-Buildings

Land

Accumulated Depreciation-Equipment

Land for Future Plant Site

Accumulated Other Comprehensive Income

Loss from Flood

Advances to Employees

Noncontrolling Interest

Advertising Expense

Notes Payable (due next year)

Allowance for Doubtful Accounts

Paid-in Capital in Excess of Par-Preferred Stock

Bond Sinking Fund

Patents

Bonds Payable

Payroll Taxes Payable

Buildings

Pension Liability

Cash (in bank)

Petty Cash

Cash (on hand)

Preferred Stock

Cash Surrender Value of Life Insurance

Premium on Bonds Payable

Commission Expense

Prepaid Rent

Common Stock

Purchase Returns and Allowances

Copyrights

Purchases

Debt Investments (trading)

Retained Earnings

Dividends Payable

Salaries and Wages Expense (sales)

Equipment

Salaries and Wages Payable

Freight-In

Sales Discounts Gain on Disposal of Equipment

Sales Revenue

Interest Receivable

Treasury Stock (at cost)

Inventory-Beginning

Unearned Subscriptions Revenue

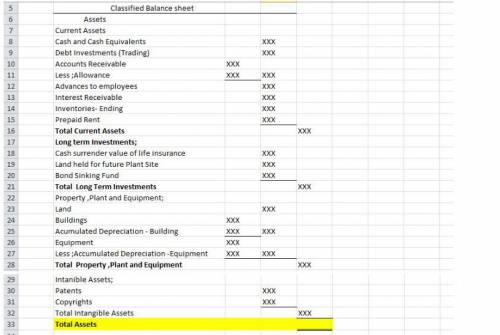

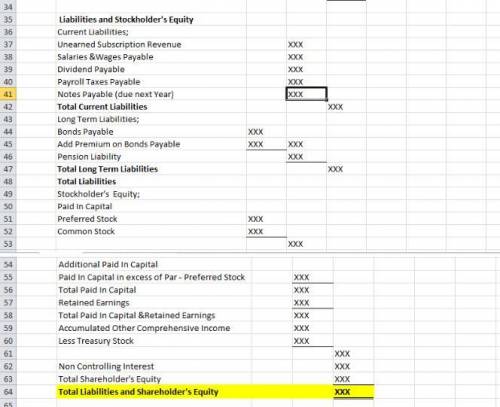

Prepare a classified balance sheet in good form. (No monetary amounts are to be shown.) (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Building, and Equipment.

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

Which job role belongs in the middle management level? a. president b. chief executive officer c. department manager d. chief operating officer e. vice president

Answers: 1

Business, 21.06.2019 23:30

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 01:30

Eliminating entries (including goodwill impairment) and worksheets for various years on january 1, 2013, porter company purchased an 80% interest in the capital stock of salem company for$850,000. at that time, salem company had capital stock of $550,000 and retained earnings of $80,000.differences between the fair value and the book value of the identifiable assets of salem company were asfollows: fair value in excess of book valueequipment$130,000land65,000inventory40,000the book values of all other assets and liabilities of salem company were equal to their fair values onjanuary 1, 2013. the equipment had a remaining life of five years on january 1, 2013. the inventory was sold in2013.salem company’s net income and dividends declared in 2013 and 2014 were as follows: year 2013 net income of $100,000; dividends declared of $25,000year 2014 net income of $110,000; dividends declared of $35,000required: a.prepare a computation and allocation schedule for the difference between book value of equity acquired andthe value implied by the purchase price.b.present the eliminating/adjusting entries needed on the consolidated worksheet for the year endeddecember 31, 2013. (it is not necessary to prepare the worksheet.)lo6lo1

Answers: 1

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

You know the right answer?

Presented below is a list of accounts in alphabetical order.

Accounts Receivable

...

Accounts Receivable

...

Questions

Arts, 24.02.2021 07:10

Mathematics, 24.02.2021 07:10

History, 24.02.2021 07:10

Mathematics, 24.02.2021 07:10

Mathematics, 24.02.2021 07:10

Social Studies, 24.02.2021 07:10

History, 24.02.2021 07:10

English, 24.02.2021 07:10

Social Studies, 24.02.2021 07:10

Social Studies, 24.02.2021 07:10