Business, 19.03.2020 20:50 briannabo08

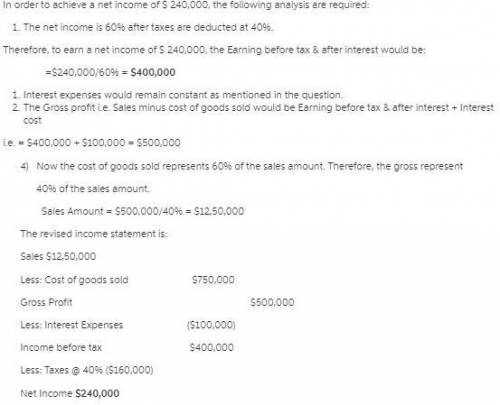

8. Hebner Housing Corporation has forecast the following numbers for this upcoming year: Sales $1,000,000 Cost of Goods Sold 600,000 Interest Expense 100,000 Net Income 180,000 The company is in the 40 percent tax bracket. Its cost of goods sold always represents 60 percent of its sales. The company’s CEO is unhappy with the forecast and wants the firm to achieve a net income equal to $300,000. Assume that Hebner’s interest expense remains constant. In order to achieve this level of net income, what level of sales will the company have to achieve?

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

You are opening a new store and must project in your business plan the amount of inventory shrinkage. you have forecasted $1,200,000 in sales for the first year. assuming your shrinkage will be 5%, the high end of the national average, calculate the projected annual shrinkage for your business plan. you are opening a new store and must project in your business plan the amount of inventory shrinkage. you have forecasted $1,200,000 in sales for the first year. assuming your shrinkage will be 5%, the high end of the national average, calculate the projected annual shrinkage for your business plan.

Answers: 3

Business, 21.06.2019 19:50

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th?

Answers: 1

Business, 22.06.2019 01:30

Monica needs to assess the slide sequence and make quick changes to it. which view should she use in her presentation program? a. outline b. slide show c. slide sorter d. notes page e. handout

Answers: 1

Business, 22.06.2019 13:40

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

You know the right answer?

8. Hebner Housing Corporation has forecast the following numbers for this upcoming year: Sales $1,00...

Questions

History, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

History, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

Biology, 02.07.2019 11:30

History, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

Computers and Technology, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30

Chemistry, 02.07.2019 11:30

Mathematics, 02.07.2019 11:30