Windsor Corp. has a deferred tax asset account with a balance of $163,880 at the end of 2016 due to a single cumulative temporary difference of $409,700. At the end of 2017, this same temporary difference has increased to a cumulative amount of $470,800. Taxable income for 2017 is $861,700. The tax rate is 40% for all years. At the end of 2016, Windsor Corp. had a valuation account related to its deferred tax asset of $44,800.

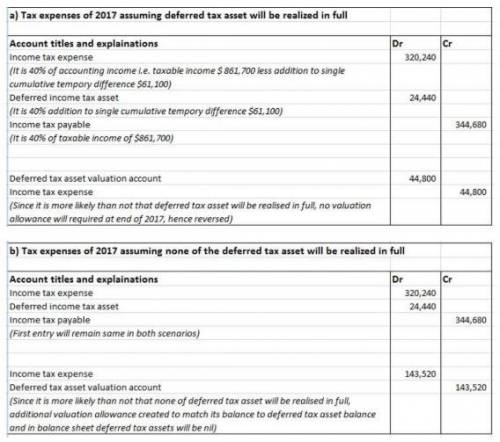

(a) Record income tax expense, deferred income taxes, and income taxes payable for 2017, assuming that it is more likely than not that the deferred tax asset will be realized in full.

(b) Record income tax expense, deferred income taxes, and income taxes payable for 2017, assuming that it is more likely than not that none of the deferred tax asset will be realized.

Answers: 3

Another question on Business

Business, 22.06.2019 15:00

Beagle autos is known for its affordable and reliable brand of consumer vehicles. because its shareholders expect to see an improved rate of growth in the coming years, beagle's executives have decided to diversify the company's range of products so that at least 40 percent of the firm's revenue is generated by new business units. however, the company's resources, capabilities, and competencies are limited to producing other forms of motorized vehicles, such as motorcycles and all-terrain vehicles (atvs). which type of corporate diversification strategy should beagle pursue?

Answers: 1

Business, 22.06.2019 20:30

The former chairman of the federal reserve, alan greenspan, used the term "irrational exuberance" in 1996 to describe the high levels of optimism among stock market investors at the time. stock market indexes such as the s& p composite price index were at an all-time high. some commentators believed that the fed should intervene to slow the expansion of the economy. why would central banks want to clamp down when the economy is growing? a. to block the formation of unsustainable speculative asset bubbles. b. to curtail excessive profits in the banking system. c. to prevent inflationary forces from gathering momentum. d. all of the above. e. a and c only.

Answers: 3

Business, 22.06.2019 22:10

Asupermarket has been experiencing long lines during peak periods of the day. the problem is noticeably worse on certain days of the week, and the peak periods are sometimes different according to the day of the week. there are usually enough workers on the job to open all cash registers. the problem is knowing when to call some of the workers stocking shelves up to the front to work the checkout counters. how might decision models the supermarket? what data would be needed to develop these models?

Answers: 2

Business, 23.06.2019 02:30

Interview notes mike is 50 and made $36,000 in wages in 2017. he is single and pays all the cost of keeping up his home. mike's daughter, brittany, lived with mike all year. brittany's son, hayden, was born in november 2017. hayden lived in mike's home since birth. brittany is 25, single, and had $1,500 in wages in 2017. she is not disabled. mike provides more than half of the support for both brittany and hayden. mike, brittany, and hayden are all u.s. citizens with valid social security numbers. 4. who can mike claim as a qualifying child(ren) for the earned income credit?

Answers: 1

You know the right answer?

Windsor Corp. has a deferred tax asset account with a balance of $163,880 at the end of 2016 due to...

Questions

Mathematics, 23.07.2019 22:00

History, 23.07.2019 22:00

Mathematics, 23.07.2019 22:00

Mathematics, 23.07.2019 22:00

Biology, 23.07.2019 22:00

Chemistry, 23.07.2019 22:00

Geography, 23.07.2019 22:00

History, 23.07.2019 22:00