Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 &...

Business, 20.03.2020 09:11 lisacarter0804

Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 & afterwards

FCF $5 million $ 5.5 million 3% constant growth rate

Debt level $50 million $35 million Constant debt to equity ratio. Capital will be 50% debt and 50% equity, wd = ws = 0.5.

The cost of debt is 5%

The cost of equity is 20%

The tax rate is 40%

The company has 15 million shares outstanding

The current stock price is $2.05

The company is currently holding no financial assets.

The company has $3,000,000 in debt.

WACC, the cost of capital, is equal to 11.5%

RSU, the cost of unlevered equity, is equal to 12.5%

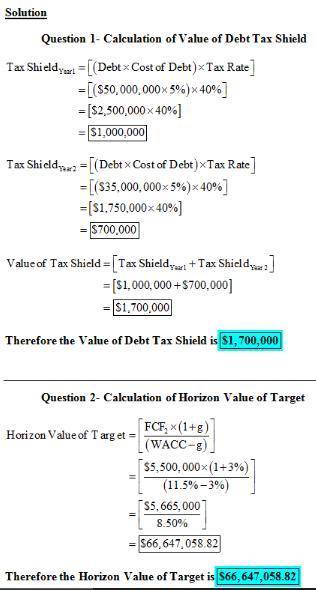

a. Calculate the value of the debt tax shield.

b. Calculate the horizon value of the target.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

The following accounts appeared in recent financial statements of delta air lines. identify each account as either a balance sheet account or an income statement account. for each balance sheet account, identify it as an asset, a liability, or stockholders' equity. for each income statement account, identify it as a revenue or an expense. item financial statement type of account accounts payable balance sheet advanced payments for equipment balance sheet air traffic liability balance sheet aircraft fuel (expense) income statement aircraft maintenance (expense) income statement aircraft rent (expense) income statement cargo revenue income statement cash balance sheet contract carrier arrangements (expense) income statement flight equipment balance sheet frequent flyer (obligations) balance sheet fuel inventory balance sheet landing fees (expense) income statement parts and supplies inventories balance sheet passenger commissions (expense) income statement passenger revenue income statement prepaid expenses income statement taxes payable balance sheet

Answers: 1

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 23.06.2019 00:00

The undress company produces a dress that women use to quickly and easily change in public. the company is just over a year old and has been successful through a kickstarter campaign. the undress company has identified a customer segment, but if it wants to reach a larger customer segment market outside of the kickstarter family, what question must it answer?

Answers: 1

Business, 23.06.2019 03:00

Predict how the price of athletic shorts would change if schools banned their use

Answers: 2

You know the right answer?

Questions

History, 04.11.2019 20:31

Biology, 04.11.2019 20:31

Mathematics, 04.11.2019 20:31

Physics, 04.11.2019 20:31

Mathematics, 04.11.2019 20:31

Mathematics, 04.11.2019 20:31

History, 04.11.2019 20:31

Spanish, 04.11.2019 20:31