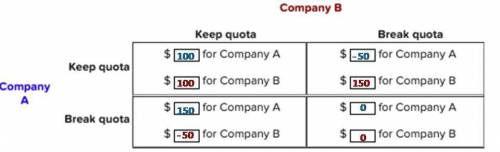

Model this situation as a prisoner’s dilemma in which the players are Company A and Company B, and the strategies are to keep the quota and break the quota. Suppose that if both companies keep the quota, then each receives a payoff of $100, and if both break the quota, then each receives a payoff of $0. On the other hand, if one company breaks the quota and the other keeps the quota, then the company that breaks the quota receives a payoff of $150, and the company that keeps the quota receives a payoff of -$50.

Answers: 3

Another question on Business

Business, 22.06.2019 07:50

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 20:40

Which one of the following statements is correct? process costing systems use periodic inventory systems. process costing systems assign costs to departments or processes for a time period. companies that produce many different products or services are more likely to use process costing systems. production is continuous when a job-order costing is used to ensure that adequate quantities are on hand.

Answers: 2

Business, 22.06.2019 22:00

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm.b. implicit costs.c. operating costs.d. fixed costs.

Answers: 2

You know the right answer?

Model this situation as a prisoner’s dilemma in which the players are Company A and Company B, and t...

Questions

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Health, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40