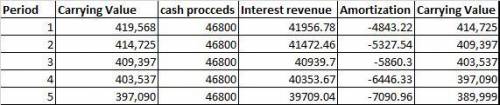

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,567.77. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Monty Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category. Prepare the journal entry at the date of the bond purchase. Prepare a bond amortization schedule. Prepare the journal entry to record the interest revenue and the amortization at December 31.

Answers: 2

Another question on Business

Business, 22.06.2019 07:50

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 19:00

Consider the following information on stocks a, b, c and their returns (in decimals) in each state: state prob. of state a b c boom 20% 0.27 0.22 0.16 good 45% 0.16 0.09 0.07 poor 25% 0.03 0 0.03 bust 10% -0.08 -0.04 -0.02 if your portfolio is invested 25% in a, 40% in b, and 35% in c, what is the standard deviation of the portfolio in percent? answer to two decimals, carry intermediate calcs. to at least four decimals.

Answers: 2

You know the right answer?

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,...

Questions

Mathematics, 26.01.2021 18:00

Mathematics, 26.01.2021 18:00

Mathematics, 26.01.2021 18:00

Physics, 26.01.2021 18:00

Mathematics, 26.01.2021 18:00

Mathematics, 26.01.2021 18:00

Mathematics, 26.01.2021 18:00

Chemistry, 26.01.2021 18:00

![\left[\begin{array}{cccccc}#&$B.Carrying&$cash&$Interest&$Amortization&$E.Carrying\\1&419567.77&46800&41956.78&-4843.22&414724.55\\2&414724.55&46800&41472.46&-5327.54&409397.01\\3&409397.01&46800&40939.7&-5860.3&403536.71\\4&403536.71&46800&40353.67&-6446.33&397090.38\\5&397090.38&46800&39709.04&-7090.96&389999.42\\\end{array}\right]](/tpl/images/0559/5401/386bc.png)