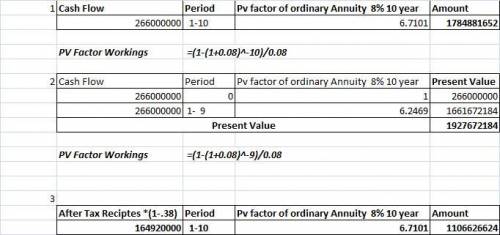

In 2000, a star major-league baseball player signed a 10-year, $266 million contract with the Texas Rangers. Assume that equal payments would have been made each year to this individual and that the owner’s cost of capital (discount rate) was 8% at the time the contract was signed. What is the present value cost of the contract to the owners as of January 1, 2000, the date the contract was signed, in each of the following independent situations?

Answers: 3

Another question on Business

Business, 21.06.2019 15:00

What was involved in the american express bluework program? select one: a. employees are provided with opportunities for flexible arrangements b. a system that tracks the hours each employee works in a given day c. employees can work on tasks they choose, as long as they are in the office d. employees who are wary of newer technologies e. employees are provided with better office facilities so they stay in the office longer?

Answers: 3

Business, 22.06.2019 12:30

On june 1, 2017, blossom company was started with an initial investment in the company of $22,360 cash. here are the assets, liabilities, and common stock of the company at june 30, 2017, and the revenues and expenses for the month of june, its first month of operations: cash $4,960 notes payable $12,720 accounts receivable 4,340 accounts payable 840 service revenue 7,860 supplies expense 1,100 supplies 2,300 maintenance and repairs expense 700 advertising expense 400 utilities expense 200 equipment 26,360 salaries and wages expense 1,760 common stock 22,360 in june, the company issued no additional stock but paid dividends of $1,660. prepare an income statement for the month of june.

Answers: 3

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

You know the right answer?

In 2000, a star major-league baseball player signed a 10-year, $266 million contract with the Texas...

Questions

Mathematics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Computers and Technology, 12.05.2021 23:00

English, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Physics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00

Mathematics, 12.05.2021 23:00