Hawke Skateboards is considering building a new plant. Bob Skerritt, the company's marketing manager, is an enthusiastic supporter of the new plant. Lucy Liu, the company's chief financial officer, is not so sure that the new plant is a good idea. Currently, the company purchases its skateboards from foreign manufacturers. The following figures were estimated regarding the construction of a new plant.

Cost of plant - $4,160,000

Estimated useful life -15 years

Annual cash inflows - 4,160,000

Salvage value - $2,080,000

Annual cash outflows - 3,682,000

Discount rate - 11%

Bob Skerritt believes that these figures understate the true potential value of the plant. He suggests that by manufacturing its own skateboards the company will benefit from a "buy American" patriotism that he believes is common among skateboarders. He also notes that the firm has had numerous quality problems with the skateboards manufactured by its suppliers. He suggests that the inconsistent quality has resulted in lost sales, increased warranty claims, and some costly lawsuits.

Overall, he believes sales will be $208,000 higher than projected above, and that the savings from lower warranty costs and legal costs will be $62,000 per year. He also believes that the project is not as risky as assumed above and that a 9% discount rate is more reasonable.

Answer each of the following.

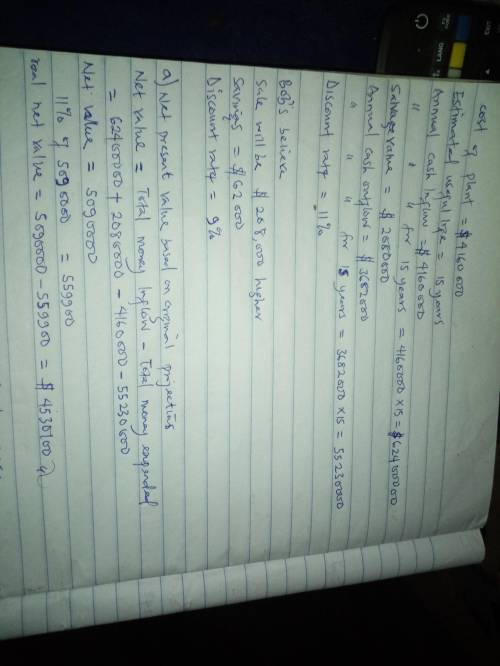

a. Compute the net present value of the project based on the original projections.

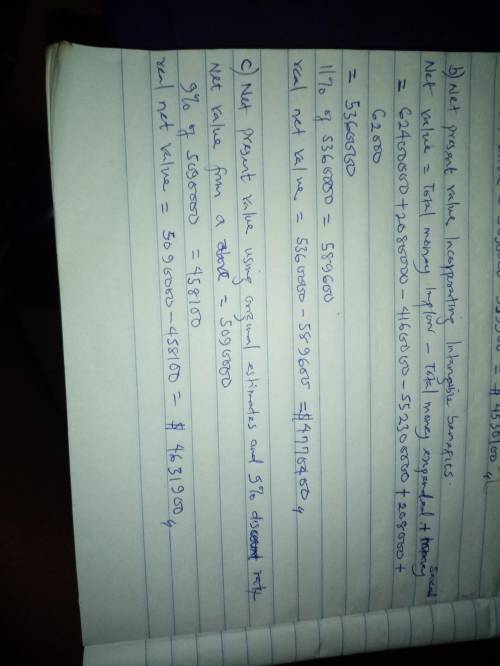

b. Compute the net present value incorporating Bob's estimates of the value of the intangible benefits, but still using the 11% discount rate.

c. Compute the net present value using the original estimates, but employing the 9% discount rate that Bob suggests is more appropriate.

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

Owning a word is a characteristic of a powerful a. productb. servicec. organization d. brand

Answers: 2

Business, 22.06.2019 05:20

142"what is the value of n? soefon11402bebe99918+19: 00esseeshop60-990 0esle

Answers: 1

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

You know the right answer?

Hawke Skateboards is considering building a new plant. Bob Skerritt, the company's marketing manager...

Questions

Mathematics, 03.02.2020 16:01

Mathematics, 03.02.2020 16:01

Mathematics, 03.02.2020 16:01

Mathematics, 03.02.2020 16:01

Chemistry, 03.02.2020 16:01

Mathematics, 03.02.2020 16:01

Spanish, 03.02.2020 16:01

Mathematics, 03.02.2020 16:01