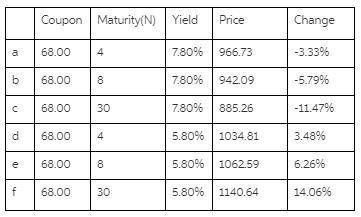

Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

a. What will be the price of the 4-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

b. What will be the price of the 8-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

c. What will be the price of the 30-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

d. What will be the price of the 4-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

e. What will be the price of the 8-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

f. What will be the price of the 30-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

g. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates?

More or less affected

h. Comparing your answers to parts (d), (e), and (f), are long-term bonds more or less affected than short-term bonds by a decline in interest rates?

More or less affected

Answers: 1

Another question on Business

Business, 22.06.2019 06:20

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u.s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

Business, 22.06.2019 15:40

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

Business, 23.06.2019 00:00

Which of the following statements is not correct? the stock of publicly owned companies must generally be registered with and reported to a regulatory agency such as the sec. when stock in a closely held corporation is offered to the public for the first time, the transaction is called "going public, or an ipo," and the market for such stock is called the new issue or ipo market. "going public" establishes a firm's true intrinsic value and ensures that a liquid market will always exist for the firm's shares. if you wanted to know what rate of return stocks have provided in the past, you could examine data on the dow jones industrial index, the s& p 500 index, or the nasdaq index.

Answers: 1

You know the right answer?

Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at f...

Questions

Social Studies, 04.08.2019 20:10

Mathematics, 04.08.2019 20:10

History, 04.08.2019 20:10

Advanced Placement (AP), 04.08.2019 20:10

Biology, 04.08.2019 20:10

Chemistry, 04.08.2019 20:10

Mathematics, 04.08.2019 20:10

Mathematics, 04.08.2019 20:10

History, 04.08.2019 20:10