Answers: 2

Another question on Business

Business, 22.06.2019 16:30

En major recording acts are able to play at the stadium. if the average profit margin for a concert is $175,000, how much would the stadium clear for all of these events combined?

Answers: 3

Business, 22.06.2019 20:30

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

Business, 22.06.2019 22:00

Which of the following is the term for something that you can't live without 1. need 2. want 3. good 4. service

Answers: 1

Business, 22.06.2019 22:20

Who owns a renter-occupied apartment? a. the government b. a landlord c. the resident d. a cooperative

Answers: 1

You know the right answer?

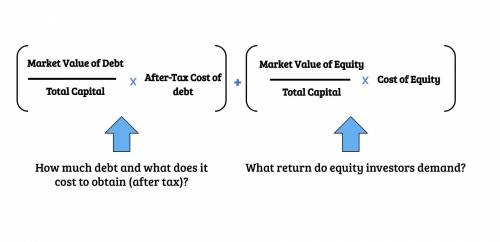

Flowercenter is 40% financed by debt with a yield-to-maturity of 8.5%. The beta of its equity is 1.3...

Questions

Biology, 29.01.2020 00:52

Mathematics, 29.01.2020 00:52

Arts, 29.01.2020 00:52

Mathematics, 29.01.2020 00:52

Physics, 29.01.2020 00:52

History, 29.01.2020 00:52

Mathematics, 29.01.2020 00:52

Biology, 29.01.2020 00:52

Mathematics, 29.01.2020 00:52

Mathematics, 29.01.2020 00:53

Biology, 29.01.2020 00:53