Haas Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations:

Variable costs per unit:

Manufacturing:

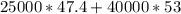

Direct materials $25

Direct labor $12

Variable manufacturing overhead $4

Variable selling and administrative $2

Fixed costs per year:

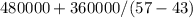

Fixed manufacturing overhead $480,000

Fixed selling and administrative expenses $360,000

During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $57 per unit.

Required:

a. Compute the company's break-even point in units sold.

b. Assume the company uses variable costing. Compute the unit product cost for year I, year 2, and year 3.

c. Prepare an income statement for year 1 , year 2, and year 3.

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Martha is the head of the accounts department in a small manufacturing company. the company follows the accrual-basis method of accounting. it recently purchased raw materials worth $5,000 from its vendors. however, the company paid only $3,000 to its vendors. it plans to pay the remaining amount after three months. considering this information, which entry should martha record in the company’s accounts? a. $5,000 as accounts receivable b. $3,000 as accounts payable c. $2,000 as accounts payable d. $2,000 as accounts receivable

Answers: 3

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 12:20

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

You know the right answer?

Haas Company manufactures and sells one product. The following information pertains to each of the c...

Questions

Business, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Computers and Technology, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Chemistry, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Computers and Technology, 22.09.2021 16:20

History, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Mathematics, 22.09.2021 16:20

Mathematics, 22.09.2021 16:30

Mathematics, 22.09.2021 16:30

= 60000 Units

= 60000 Units

= 3305000

= 3305000

= 480000

= 480000

= 460000

= 460000

= 490000

= 490000