Business, 24.03.2020 22:58 jakails3073

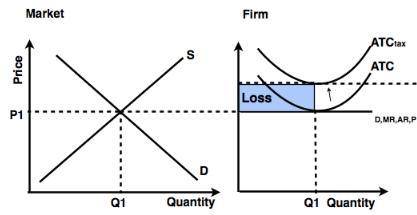

If a firm is currently in a short-run equilibrium earning a profit, what impact will a lump-sum tax have on its production decision? A. The firm will increase output but earn a lower profit. B. The firm will not change output and earn a higher profit. C. The firm will not change output but earn a lower profit. D. The firm will decrease output to earn a higher profit.

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 10:30

Marketing1. suppose the average price for a new disposable cell phone is $20, and the total market potential for that product is $4 million. topco, inc. has a planned market share of 10 percent. how many phones does topco have the potential to sell in this market? 20,0002. use the data from question 3 to calculate topco, inc.'s planned market share in dollars. $400,0003. atlantic car rental charges $29.95 per day to rent a mid-size automobile. pacific car rental, atlantic's main competitor, just reduced prices on all its car rentals. in response, atlantic reduced its prices by 5 percent. now how much does it cost to rent a mid-size automobile from atlantic? $28.45

Answers: 1

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

You know the right answer?

If a firm is currently in a short-run equilibrium earning a profit, what impact will a lump-sum tax...

Questions

Chemistry, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

Mathematics, 05.03.2021 06:10

English, 05.03.2021 06:10

English, 05.03.2021 06:10