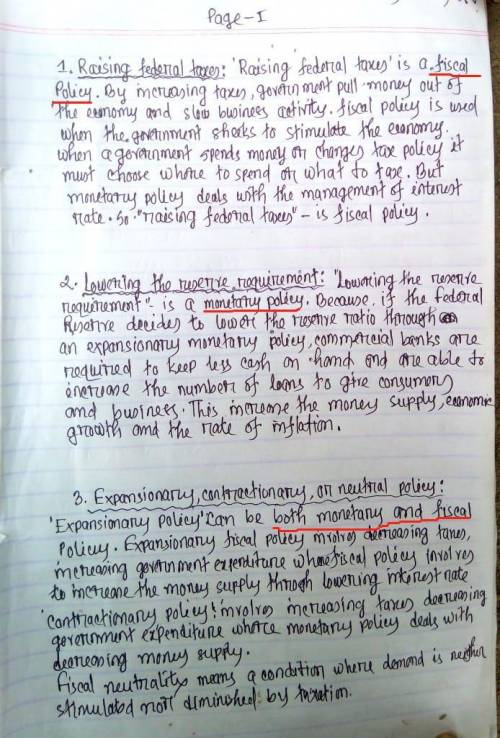

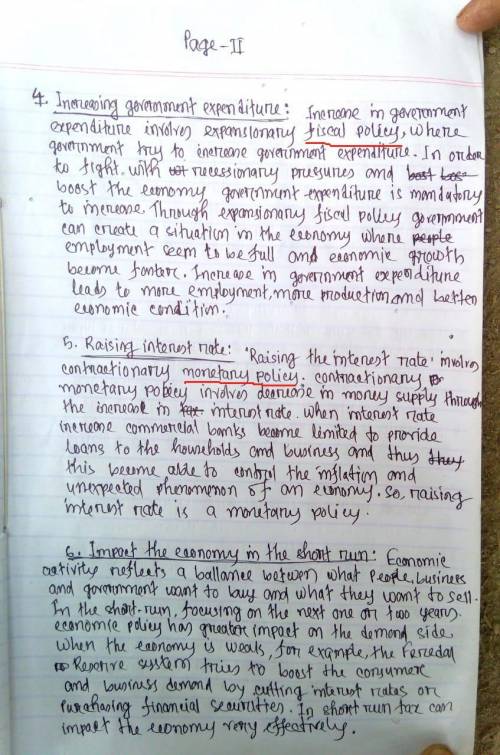

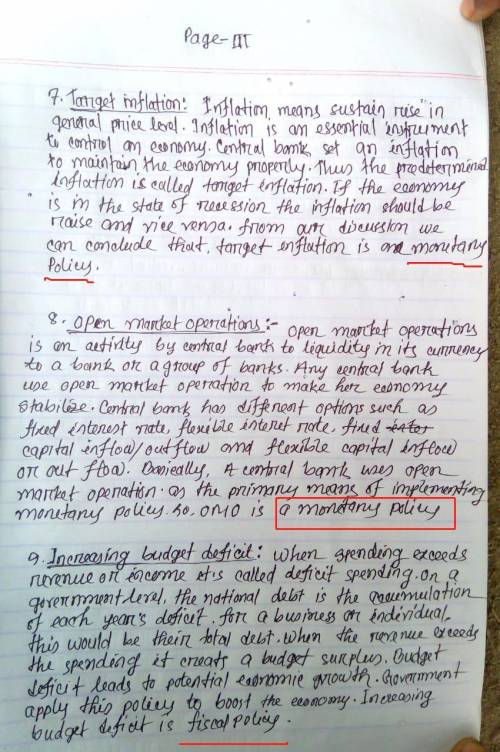

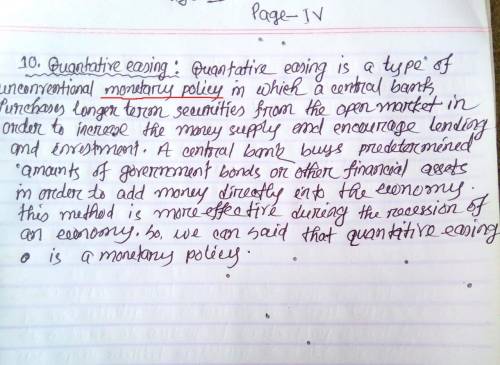

Raising federal taxes 2. Lowering the reserve requirement 3. Expansionary, contractionary, or neutral policy 4. Increasing government spending 5. Raising interest rates 6. Impact the economy in the short run 7. Target inflation 8. Open Market Operations 9. Increasing budget deficit

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Precision dyes is analyzing two machines to determine which one it should purchase. the company requires a rate of return of 15 percent and uses straight-line depreciation to a zero book value over the life of its equipment. ignore bonus depreciation. machine a has a cost of $462,000, annual aftertax cash outflows of $46,200, and a four-year life. machine b costs $898,000, has annual aftertax cash outflows of $16,500, and has a seven-year life. whichever machine is purchased will be replaced at the end of its useful life. which machine should the company purchase and how much less is that machine's eac as compared to the other machine's

Answers: 3

Business, 22.06.2019 10:20

The different concepts in the architecture operating model are aligned with how the business chooses to integrate and standardize with an enterprise solution. in the the technology solution shares data across the enterprise.

Answers: 3

Business, 22.06.2019 10:30

The advertisement demonstrates a popular way companies try to sell a product. what should consumers consider when it comes to the price of this product? it includes shipping and handling costs. it takes into account maintenance costs. it explains why this price is a good deal. it makes the full cost appears lower than it is.

Answers: 1

Business, 22.06.2019 11:20

Lusk corporation produces and sells 14,300 units of product x each month. the selling price of product x is $25 per unit, and variable expenses are $19 per unit. a study has been made concerning whether product x should be discontinued. the study shows that $72,000 of the $102,000 in monthly fixed expenses charged to product x would not be avoidable even if the product was discontinued. if product x is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

Answers: 1

You know the right answer?

Raising federal taxes 2. Lowering the reserve requirement 3. Expansionary, contractionary, or neut...

Questions

Mathematics, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01

History, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01

Health, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01

Geography, 20.10.2020 03:01

History, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01

Mathematics, 20.10.2020 03:01