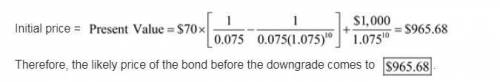

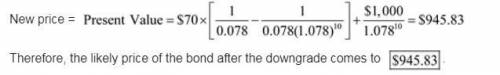

Credit Risk. A bond’s credit rating provides a guide to its risk. Suppose that long-term bonds rated Aa currently offer yields to maturity of 7.5%. A-rated bonds sell at yields of 7.8%. Suppose that a 10-year bond with a coupon rate of 7.6% is downgraded by Moody’s from an Aa to A rating. (LO6-5) a. Is the bond likely to sell above or below par value before the downgrade? b. Is the bond likely to sell above or below par value after the downgrade?

Answers: 3

Another question on Business

Business, 22.06.2019 13:30

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

Business, 23.06.2019 02:00

How much more output does the $18 trillion u.s. economy produce when gdp increases by 3.0 percen?

Answers: 1

Business, 23.06.2019 02:30

On december 1, 2017, bigham corporation pays a dividend of $4.00 on each share of its common stock. vanessa and gena, two unrelated shareholders, each own 5,000 shares of the stock. vanessa has owned her stock for two years while gena purchased her stock on november 3, 2017. how does each shareholder treat the $20,000 dividend from bigham

Answers: 3

You know the right answer?

Credit Risk. A bond’s credit rating provides a guide to its risk. Suppose that long-term bonds rated...

Questions

Mathematics, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

English, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Physics, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Social Studies, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Mathematics, 23.03.2021 21:50

Arts, 23.03.2021 21:50