Business, 26.03.2020 20:36 xXFLUFFYXx

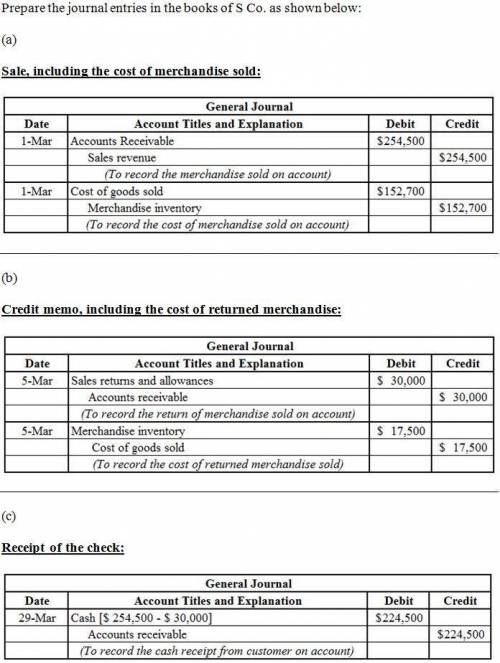

On March 1, Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $254,500, terms n/30. The cost of the merchandise sold is $152,700. Showcase Co. issues a credit memo on March 5 for $30,000 for merchandise returned prior to Balboa Co. paying the original invoice on March 29. The cost of the merchandise returned is $17,500. Journalize Showcase Co.’s entries for (a) the sale, including the cost of the merchandise sold, (b) the credit memo, including the cost of the returned merchandise, and (c) the receipt of the check for the amount due from Balboa Co. Refer to the Chart of Accounts for exact wording of account titles.

Answers: 1

Another question on Business

Business, 21.06.2019 22:00

When slick heating company switched to an activity based costing system, it realized that it was allocating a much lower percentage of factory overhead to a product line that the marketing department was trying to push. the product line may contain which type of products?

Answers: 2

Business, 22.06.2019 17:30

According to management education expert ashok rao, companies can increase their profitability by through careful inventory management. a. 5% to 10% b. 10% to 25% c. 20% to 50% d. 75%

Answers: 1

Business, 22.06.2019 23:00

Doogan corporation makes a product with the following standard costs: standard quantity or hours standard price or rate direct materials 2.0 grams $ 7.00 per gram direct labor 1.6 hours $ 12.00 per hour variable overhead 1.6 hours $ 6.00 per hour the company produced 5,000 units in january using 10,340 grams of direct material and 2,320 direct labor-hours. during the month, the company purchased 10,910 grams of the direct material at $7.30 per gram. the actual direct labor rate was $12.85 per hour and the actual variable overhead rate was $5.80 per hour. the company applies variable overhead on the basis of direct labor-hours. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for january is:

Answers: 1

Business, 23.06.2019 08:00

Whom do progressive taxes assess? a. only a large percentage of high-income households b. only a large percentage of organizations c. a large percentage of high-income households and organizations d. a large percentage of low-income households e. a small percentage of high-income households

Answers: 1

You know the right answer?

On March 1, Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $254,5...

Questions

History, 20.08.2019 09:30

Social Studies, 20.08.2019 09:30

Mathematics, 20.08.2019 09:30

Mathematics, 20.08.2019 09:30

Mathematics, 20.08.2019 09:30

Mathematics, 20.08.2019 09:30

History, 20.08.2019 09:30

Social Studies, 20.08.2019 09:30

Social Studies, 20.08.2019 09:30

Biology, 20.08.2019 09:30