Suppose that a firm’s recent earnings per share and dividend per share are $2.50 and $1.50, respectively. Both are expected to grow at 9 percent. However, the firm’s current P/E ratio of 24 seems high for this growth rate. The P/E ratio is expected to fall to 20 within five years.

Compute the dividends over the next five years.

Compute the value of this stock in five years.

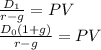

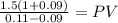

Calculate the present value of these cash flows using an 11 percent discount rate.

Answers: 1

Another question on Business

Business, 22.06.2019 17:30

What is the sequence of events that could lead to trade surplus

Answers: 3

Business, 23.06.2019 11:00

If you wanted to gain workplace experience and learn more about a company, what opportunity would be most ? a. job shadowing b. an informational interview c. an internship d. online research

Answers: 2

Business, 23.06.2019 21:30

Goals are broad accomplishments that an organization wants to achieve within a certain time frame-in most companies, this is about

Answers: 1

You know the right answer?

Suppose that a firm’s recent earnings per share and dividend per share are $2.50 and $1.50, respec...

Questions

English, 22.04.2021 02:50

Mathematics, 22.04.2021 02:50

English, 22.04.2021 02:50

Mathematics, 22.04.2021 02:50

English, 22.04.2021 02:50

Mathematics, 22.04.2021 02:50

Chemistry, 22.04.2021 02:50

Social Studies, 22.04.2021 02:50

Chemistry, 22.04.2021 02:50

History, 22.04.2021 02:50

Mathematics, 22.04.2021 02:50