Business, 30.03.2020 17:47 Har13526574

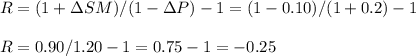

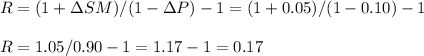

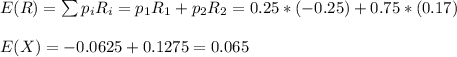

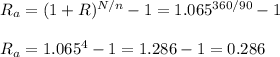

Consider the following hypothetical facts about Mexico: The peso recently lost over 40% of its value relative to the dollar. Over the course of the next 90 days, there is a 25% chance that the Mexican government will lose control of the economy. If it does, the peso will lose 20% of its value relative to the dollar, and the Mexican stock market will fall by 10%. Alternatively, the U. S. Congress may vote to help Mexico by offering collateral for Mexican government loans. In that case, the peso will appreciate 10% relative to the dollar, and the Mexican stock market will rise by 5%. As a U. S. investor with no current assets or liabilities in Mexico, you have decided to speculate. Calculate your expected dollar return from investing dollars in the Mexican stock market for the next 90 days. Express the return in annualized terms.

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following explains why the government sets a required reserve ratio for private banks? a. to allow the government to control the interest rate charged on loans. b. to prevent banks from printing too much money and causing inflation. c. to make sure banks don't run out of money when customers make withdrawals. d. to enable the regulation of risk levels in the decision process of offering loans. 2b2t

Answers: 1

Business, 21.06.2019 20:40

Maria am corporation uses the weighted-average method in its process costing system. the baking department is one of the processing departments in its strudel manufacturing facility. in june in the baking department, the cost of beginning work in process inventory was $4,880, the cost of ending work in process inventory was $1,150, and the cost added to production was $25,200. required: prepare a cost reconciliation report for the baking department for june.

Answers: 2

Business, 22.06.2019 08:30

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 11:00

Acompany that adapts its product mix to meet the needs of a new market is using which of the following global marketing strategies market development diversification strategy product development undiversified

Answers: 3

You know the right answer?

Consider the following hypothetical facts about Mexico: The peso recently lost over 40% of its value...

Questions

Mathematics, 21.04.2021 05:00

Chemistry, 21.04.2021 05:00

Mathematics, 21.04.2021 05:00

Advanced Placement (AP), 21.04.2021 05:00

Chemistry, 21.04.2021 05:00

Chemistry, 21.04.2021 05:00

Geography, 21.04.2021 05:00

Mathematics, 21.04.2021 05:00