Business, 30.03.2020 21:41 earcake2470

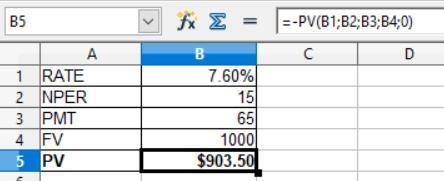

Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of €1,000, 15 years to maturity, and a coupon rate of 6.5 percent paid annually. If the yield to maturity is 7.6 percent, what is the current price of the bond?

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 16:30

:; )write a paragraph of two to three sentences and describe what will happen to a society that does not have a productive workforce?

Answers: 3

Business, 23.06.2019 01:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 3

You know the right answer?

Even though most corporate bonds in the United States make coupon payments semiannually, bonds issue...

Questions

English, 21.06.2021 22:10

Mathematics, 21.06.2021 22:10

Biology, 21.06.2021 22:10

Chemistry, 21.06.2021 22:10

Mathematics, 21.06.2021 22:10

Mathematics, 21.06.2021 22:10

Mathematics, 21.06.2021 22:10

Mathematics, 21.06.2021 22:10

Mathematics, 21.06.2021 22:20

Mathematics, 21.06.2021 22:20

History, 21.06.2021 22:20

Mathematics, 21.06.2021 22:20

Mathematics, 21.06.2021 22:20

English, 21.06.2021 22:20

Mathematics, 21.06.2021 22:20

History, 21.06.2021 22:20