Business, 30.03.2020 21:12 andrejr0330jr

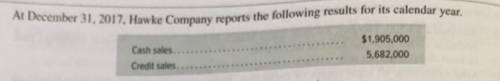

On December 31, 2017, Hawke Company reported the following results for its calendar year: Cash sales of 5,682,000 and credit sales of 0. In addition, its unadjusted trial balance includes the following items: $1,270,100 debit; 16,580 debit. Required under each of the following independent assumptions:

A) Prepare the adjusting entry for this company to recognize the bad debts:

Bad debts are estimated to be 1.5% of credit sales.

Bad debts are estimated to be 1% of total sales.

An aging analysis estimates that 5% of year-end accounts receivable are uncollectible.

B) Show how the Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet, given the facts in Part A.

C) Check the Bad Debts Expense ($85,230). Show how the Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet, given the facts in Part A.

Answers: 1

Another question on Business

Business, 21.06.2019 21:10

Of the roles commonly found in the development, maintenance, and compliance efforts related to a policy and standards library, which of the following has the responsibilities of directing policies and procedures designed to protect information resources, identifying vulnerabilities, and developing a security awareness program?

Answers: 3

Business, 21.06.2019 21:30

The following account balances at the beginning of january were selected from the general ledger of fresh bagel manufacturing company: work in process inventory $0 raw materials inventory $ 28 comma 100 finished goods inventory $ 40 comma 600 additional data: 1. actual manufacturing overhead for january amounted to $ 65 comma 000. 2. total direct labor cost for january was $ 63 comma 400. 3. the predetermined manufacturing overhead rate is based on direct labor cost. the budget for the year called for $ 255 comma 000 of direct labor cost and $ 382 comma 500 of manufacturing overhead costs. 4. the only job unfinished on january 31 was job no. 151, for which total direct labor charges were $ 5 comma 200 (1 comma 300 direct labor hours) and total direct material charges were $ 14 comma 400. 5. cost of direct materials placed in production during january totaled $ 123 comma 700. there were no indirect material requisitions during january. 6. january 31 balance in raw materials inventory was $ 35 comma 300. 7. finished goods inventory balance on january 31 was $ 35 comma 400. what is the cost of goods manufactured for january?

Answers: 3

Business, 22.06.2019 19:00

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

Business, 22.06.2019 19:10

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

You know the right answer?

On December 31, 2017, Hawke Company reported the following results for its calendar year: Cash sales...

Questions

Mathematics, 26.08.2019 01:50

Mathematics, 26.08.2019 01:50

Mathematics, 26.08.2019 01:50

History, 26.08.2019 01:50

Mathematics, 26.08.2019 01:50

Biology, 26.08.2019 01:50

History, 26.08.2019 01:50

History, 26.08.2019 01:50

Mathematics, 26.08.2019 01:50