Business, 30.03.2020 21:36 carlinryan

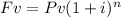

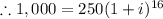

You are considering investing in a zero-coupon bond that sells for $250. At maturity in 16 years it will be redeemed for $1,000. What approximate annual rate of growth does this represent?

Answers: 2

Another question on Business

Business, 21.06.2019 16:40

Dollywood corporation accumulates the following data concerning a mixed cost, using miles as the activity level. miles driven total cost january 10,000 $16,500 february 8,000 $14,500 march 9,000 $12,500 april 7,000 $12,000 compute the variable and fixed cost elements using the high-low method

Answers: 3

Business, 21.06.2019 17:00

What are ways individuals may reduce their total education and training costs?

Answers: 3

Business, 21.06.2019 20:30

Which of the following actions would be most likely to reduce potential conflicts of interest between stockholders and bondholders? a) compensating managers with stock options, b) financing risky projects with additional debt, c) the threat of hostile takeovers, d) the use of covenants in bond agreements that limit the firm's use of additional debt and constrain managers actions, e) abolishing the security and exchange commission

Answers: 1

Business, 23.06.2019 00:00

What is a uniform law adopted by all states that facilitates business transactions?

Answers: 1

You know the right answer?

You are considering investing in a zero-coupon bond that sells for $250. At maturity in 16 years it...

Questions

Social Studies, 07.11.2019 01:31

(approx)

(approx)