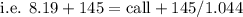

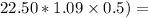

The common stock of the C. A.L. L. Corporation has been trading in a narrow range around $145 per share for months, and you believe it is going to stay in that range for the next 6 months. The price of a 6-month put option with an exercise price of $145 is $8.19. a. If the risk-free interest rate is 9% per year, what must be the price of a 6-month call option on C. A.L. L. stock at an exercise price of $145 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) b-1. What would be a simple options strategy using a put and a call to exploit your conviction about the stock price’s future movement? b-2. What is the most money you can make on this position? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b-3. How far can the stock price move in either direction before you lose money? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? What is the net cost of establishing that position now? (Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

Answers: 2

Another question on Business

Business, 22.06.2019 03:10

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

Business, 22.06.2019 15:10

Paddock pools constructed a swimming pool and deck for the jensens' home. paddock installed the wrong trim on the pool. it would cost $2800 to change the trim-one-fifth of the total cost of the pool. the jensens refuse to pay anything for the pool. the paddock's best defense is: (a) duress (b) substanial performance (c)mistake (d) failure of conditions

Answers: 3

Business, 22.06.2019 16:40

Consider two similar industries, portal crane manufacturing (pcm) and forklift manufacturing (flm). the pcm industry has exactly three incumbents with annual sales of $800 million, $200 million and $100 million, respectively. the flm industry has also exactly three incumbents, with annual sales of $500 million, $450 million and $400 million, respectively. which industry is more likely to experience a higher level of rivalry?

Answers: 3

You know the right answer?

The common stock of the C. A.L. L. Corporation has been trading in a narrow range around $145 per sh...

Questions

Mathematics, 19.03.2021 22:00

Mathematics, 19.03.2021 22:00

Mathematics, 19.03.2021 22:00

Social Studies, 19.03.2021 22:00

Chemistry, 19.03.2021 22:00

$ 23.49 for us to start incurring losses.

$ 23.49 for us to start incurring losses.

145 145

145 145