Business, 31.03.2020 01:51 ranamontana98

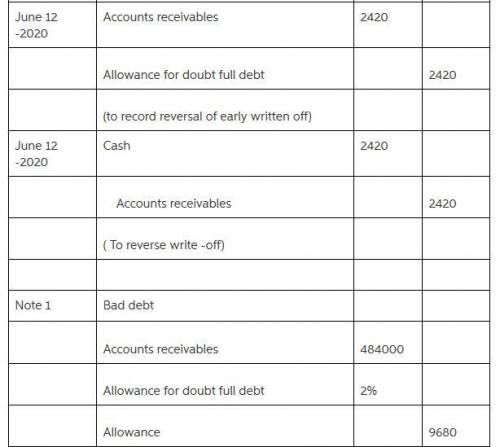

On December 31, 2020, Whispering Winds Corp. estimated that 3% of its net accounts receivable of $408,000 will become uncollectible. The company recorded this amount as an addition to Allowance for Doubtful Accounts. The allowance account had a zero balance before adjustment on December 31, 2020. On May 11, 2021, Whispering Winds Corp. determined that the Jeff Shoemaker account was uncollectible and wrote off $2,040. On June 12, 2021, Shoemaker paid the amount previously written off.

Answers: 3

Another question on Business

Business, 23.06.2019 00:50

Mr. drucker uses a periodic review system to manage the inventory in his dry goods store. he likes to maintain 15 sacks of sugar on his shelves based on the annual demand figure of 225 sacks. it costs $2 to place an order for sugar and costs $1 to hold a sack in inventory for a year. mr. drucker checks inventory one day and notes that he is down to 9 sacks; how much should he order?

Answers: 1

Business, 23.06.2019 01:40

The new york times (nov. 30, 1993) reported that “the inability of opec to agree last week to cut production has sent the oil market into turmoil . . [leading to] the lowest price for domestic crude oil since june 1990.” why were the members of opec trying to agree to cut production? so they could save more oil for future consumption so they could lower the price so they could raise the price why do you suppose opec was unable to agree on cutting production? because each country has a different production capacity because each country experiences different production costs because each country has an incentive to cheat on any agreement the newspaper also noted opec’s view “that producing nations outside the organization, like norway and britain, should do their share and cut production.” what does the phrase “do their share” suggest about opec’s desired relationship with norway and britain? opec would like norway and britain to keep their production levels high. opec would like norway and britain to act competitively. opec would like norway and britain to join the cartel.

Answers: 2

Business, 23.06.2019 03:00

In each of the cases below, assume division x has a product that can be sold either to outside customers or to division y of the same company for use in its production process. the managers of the divisions are evaluated based on their divisional profits. case a b division x: capacity in units 200,000 200,000 number of units being sold to outside customers 200,000 160,000 selling price per unit to outside customers $ 90 $ 75 variable costs per unit $ 70 $ 60 fixed costs per unit (based on capacity) $ 13 $ 8 division y: number of units needed for production 40,000 40,000 purchase price per unit now being paid to an outside supplier $ 86 $ 74 required: 1. refer to the data in case a above. assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. what is the lowest acceptable transfer price from the perspective of the selling division? b. what is the highest acceptable transfer price from the perspective of the buying division? c. what is the range of acceptable transfer prices (if any) between the two divisions? if the managers are free to negotiate and make decisions on their own, will a transfer probably take place?

Answers: 3

Business, 23.06.2019 06:00

Legal requirements, suppliers and distributors, competitors, and market profiles are contained in the element of your business plan. a. introduction b. operating plant c. industry d. business information

Answers: 1

You know the right answer?

On December 31, 2020, Whispering Winds Corp. estimated that 3% of its net accounts receivable of $40...

Questions

Chemistry, 28.12.2019 10:31

Biology, 28.12.2019 10:31

English, 28.12.2019 10:31

Computers and Technology, 28.12.2019 10:31

History, 28.12.2019 10:31

Biology, 28.12.2019 10:31

History, 28.12.2019 10:31