Business, 31.03.2020 01:59 shannynichole

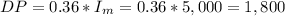

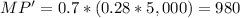

Use the following advice from most financial advisors to solve the problem. ∙ Spend no more than 28% of your gross monthly income for your mortgage payment. ∙ Spend no more than 36% of your gross monthly income for your total monthly debt. Round all calculations to the nearest dollar, if necessary. Suppose that your gross annual income is $60,000. (a) What is the maximum amount you should spend each month on a mortgage payment? (b) What is the maximum amount you should spend each month for total credit obligations? (c) If your monthly mortgage payment is 70% of the maximum amount you can afford, what is the maximum amount you should spend each month for all other debt?

Answers: 2

Another question on Business

Business, 21.06.2019 18:30

What is the communication process? why isnt it possible to communicate without using all the elements in the communication process?

Answers: 3

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 17:30

You should do all of the following before a job interview except

Answers: 2

You know the right answer?

Use the following advice from most financial advisors to solve the problem. ∙ Spend no more than 28%...

Questions

Social Studies, 19.04.2021 21:00

World Languages, 19.04.2021 21:00

History, 19.04.2021 21:00

Mathematics, 19.04.2021 21:00

Mathematics, 19.04.2021 21:00

Computers and Technology, 19.04.2021 21:00

History, 19.04.2021 21:00

Computers and Technology, 19.04.2021 21:00