Business, 02.04.2020 03:52 asapmechee

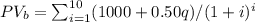

Nadine Chelesvig has patented her invention. She is offering a potential manufacturer two contracts for the exclusive right to manufacture and market her product. Plan A calls for an immediate single lump sum payment to her of $30,000. Plan B calls for an annual payment of $1,000 plus a royalty of $0.50 per unit sold. The remaining life of the patent is 10 years. Nadine uses a MARR of 10 percent/year. a. What must be the uniform annual sales volume of the product for Nadine to be indifferent between the contracts, based on a present worth analysis

Answers: 1

Another question on Business

Business, 22.06.2019 16:30

Why are there so many types of diversion programs for juveniles

Answers: 2

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 22.06.2019 21:40

Engberg company installs lawn sod in home yards. the company’s most recent monthly contribution format income statement follows: amount percent of sales sales $ 80,000 100% variable expenses 32,000 40% contribution margin 48,000 60% fixed expenses 38,000 net operating income $ 10,000 required: 1. compute the company’s degree of operating leverage. (round your answer to 1 decimal place.) 2. using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in sales. (do not round intermediate calculations.) 3. construct a new contribution format income statement for the company assuming a 5% increase in sales.

Answers: 3

You know the right answer?

Nadine Chelesvig has patented her invention. She is offering a potential manufacturer two contracts...

Questions

Mathematics, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30

Chemistry, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30

Social Studies, 07.04.2021 19:30

History, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30

Mathematics, 07.04.2021 19:30