Business, 04.04.2020 01:33 joshuabm42407

Rocky Mountain Power (RMP) maintains an inventory of spare parts that is valued at nearly $8 million. This inventory is composed of different SKUs (Stock Keeping Unit) used for power generation and utility line maintenance, and the inventory balances are updated on a computerized information system. Glass insulators (SKU1341) have a relatively stable usage, averaging at 1000 items per year. RMP purchases these items from the manufacturer at $20 per unit delivered to the Denver warehouse. An order for replenishment is placed whenever the inventory balance reaches a predetermined reorder point. The cost associated with placing an order is estimated at $30. This includes the cost of order processing, receiving and distribution to the outlying substations. An estimate of the annual inventory holding cost of SKU 1341 is estimated at $6 per unit. This holding cost represents a 30% opportunity cost of capital. SKU 1341 is essential and RMP must avoid depleting its stock of this item.

We want to determine the replenishment order for SKU 1341 which minimizes inventory costs.

Answers: 1

Another question on Business

Business, 21.06.2019 15:00

As part of a hiring process, codex marketing company conducts an internet search to discover what a job candidate has posted. to codex, this act should present

Answers: 2

Business, 21.06.2019 20:40

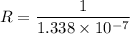

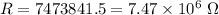

Afirm that makes electronic circuits has been ordering a certain raw material 250 ounces at a time. the firm estimates that carrying cost is i = 30% per year, and that ordering cost is about $20 per order. the current price of the ingredient is $200 per ounce. the assumptions of the basic eoq model are thought to apply. for what value of annual demand is their action optimal?

Answers: 3

Business, 22.06.2019 04:40

Dahlia enterprises needs someone to supply it with 127,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you’ve decided to bid on the contract. it will cost you $940,000 to install the equipment necessary to start production; you’ll depreciate this cost straight-line to zero over the project’s life. you estimate that in five years, this equipment can be salvaged for $77,000. your fixed production costs will be $332,000 per year, and your variable production costs should be $11.00 per carton. you also need an initial investment in net working capital of $82,000. if your tax rate is 30 percent and your required return is 11 percent on your investment, what bid price should you submit? (do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))

Answers: 3

Business, 22.06.2019 05:00

Every 10 years, the federal government sponsors a national survey of health and health practices (nhanes). one question in the survey asks participants to rate their overall health using a 5-point rating scale. what is the scale of measurement used for this question? ratio ordinal interval nominal

Answers: 1

You know the right answer?

Rocky Mountain Power (RMP) maintains an inventory of spare parts that is valued at nearly $8 million...

Questions

English, 13.12.2021 19:50

English, 13.12.2021 19:50

Biology, 13.12.2021 19:50

Mathematics, 13.12.2021 19:50

Physics, 13.12.2021 19:50

Mathematics, 13.12.2021 19:50

Geography, 13.12.2021 19:50

Business, 13.12.2021 19:50

Mathematics, 13.12.2021 19:50

.

.