Business, 06.04.2020 16:59 aileenzerr9664

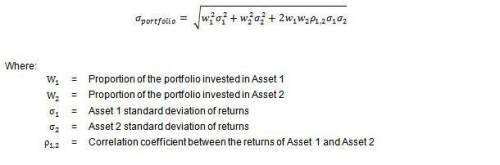

The standard deviation of a portfolio consisting of 30% of Stock X and 70% of Stock Y is:

Stock Expected Return Standard Deviation Correlation Coefficient

X 5% 20% 0.4

Y 10% 25%

A. 20.65%

B. 4.26%

C. 34.20%

D. 21%

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 15:30

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Business, 22.06.2019 20:00

Modern firms increasingly rely on other firms to supply goods and services instead of doing these tasks themselves. this increased level of is leading to increased emphasis on management.

Answers: 2

You know the right answer?

The standard deviation of a portfolio consisting of 30% of Stock X and 70% of Stock Y is:

Questions

Mathematics, 13.04.2021 03:30

Mathematics, 13.04.2021 03:30

Mathematics, 13.04.2021 03:30

Mathematics, 13.04.2021 03:30

Mathematics, 13.04.2021 03:30