Credit risk measures using the structural model: assume a company has the following characteristics.

Time t value of the firm’s assets: At = $3,000

Expected return on assets: u = 0.05 per year

Risk-free rate: r = 0.02 per year

Face value of the firm’s debt: K = $2,000

Time to maturity of the debt (tenor): T – t = 1 year

Asset return volatility: σ = 0.35 per year

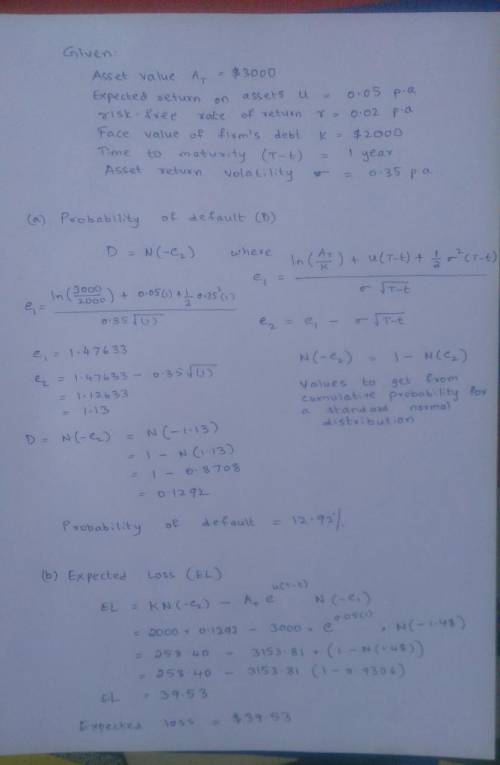

(a) Calculate the probability that the debt will default over the time to maturity.

(b) Calculate the expected loss.

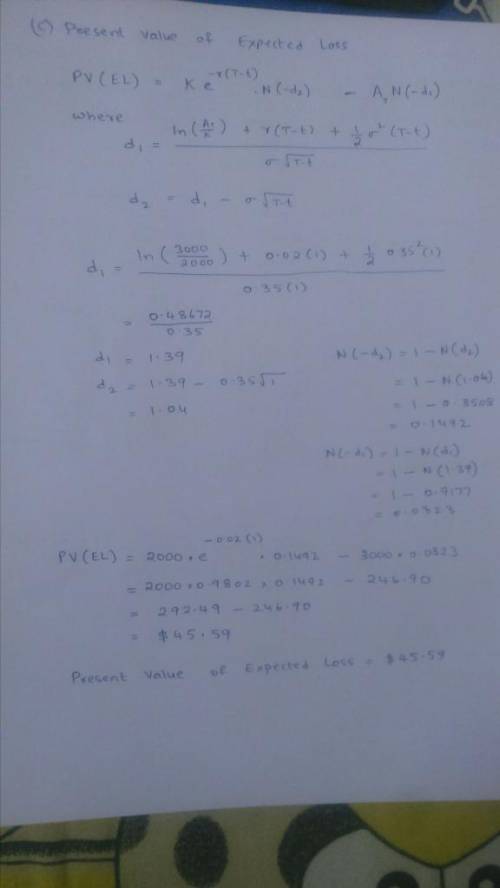

(c) Calculate the present value of the expected loss.

Answers: 1

Another question on Business

Business, 22.06.2019 05:30

U.s. internet advertising revenue grew at the rate of r(t) = 0.82t + 1.14 (0 ≤ t ≤ 4) billion dollars/year between 2002 (t = 0) and 2006 (t = 4). the advertising revenue in 2002 was $5.9 billion.† (a) find an expression f(t) giving the advertising revenue in year t.

Answers: 1

Business, 22.06.2019 08:10

What are the period and vertical shift of the cosecant function below? period: ; vertical shift: 1 unit up period: ; vertical shift: 2 units up period: ; vertical shift: 1 unit up period: ; vertical shift: 2 units up?

Answers: 3

Business, 22.06.2019 17:50

Which of the following statements is true of unsought products? as compared to convenience products, unsought products are purchased more frequently. unsought products are consumer products and services that customers usually buy frequently, immediately, and with minimal comparison and buying effort. a life insurance policy is an example of an unsought product. unsought products have strong brand identification for which a significant group of buyers is willing to make a special purchase effort. unsought products are those products purchased for further processing or for use in conducting a business.

Answers: 2

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

You know the right answer?

Credit risk measures using the structural model: assume a company has the following characteristics....

Questions

Mathematics, 27.03.2020 18:23

History, 27.03.2020 18:23

Mathematics, 27.03.2020 18:23

Mathematics, 27.03.2020 18:24

Chemistry, 27.03.2020 18:24

Mathematics, 27.03.2020 18:24

Social Studies, 27.03.2020 18:24

Mathematics, 27.03.2020 18:24

English, 27.03.2020 18:24

Health, 27.03.2020 18:24