Business, 07.04.2020 00:48 burnsmykala23

Gabbe Industries is a division of a major corporation. Last year the division had total sales of $23,510,300, net operating income of $2,562,623, and average operating assets of $7,018,000. The company's minimum required rate of return is 22%.

Required:

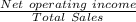

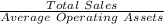

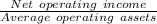

a. What is the division's margin?

b. What is the division's turnover?

c. What is the division's return on investment (ROI)?

Answers: 2

Another question on Business

Business, 21.06.2019 19:00

Sara is a manager at a restaurant with employees from different cultural backgrounds. which action of sara could employees perceive as an act of favoritism?

Answers: 1

Business, 22.06.2019 21:00

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

Business, 22.06.2019 23:30

Miller company’s most recent contribution format income statement is shown below: total per unit sales (20,000 units) $300,000 $15.00 variable expenses 180,000 9.00 contribution margin 120,000 $6.00 fixed expenses 70,000 net operating income $ 50,000 required: prepare a new contribution format income statement under each of the following conditions (consider each case independently): (do not round intermediate calculations. round your "per unit" answers to 2 decimal places.) 1. the number of units sold increases by 15%.

Answers: 1

Business, 23.06.2019 01:00

Lycan, inc., has 7.5 percent coupon bonds on the market that have 8 years left to maturity. the bonds make annual payments and have a par value of $1,000. if the ytm on these bonds is 9.5 percent, what is the current bond price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) current bond price

Answers: 2

You know the right answer?

Gabbe Industries is a division of a major corporation. Last year the division had total sales of $23...

Questions

Mathematics, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40

History, 19.11.2020 19:40

Computers and Technology, 19.11.2020 19:40

History, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40

Chemistry, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40

Chemistry, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40

Chemistry, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40

World Languages, 19.11.2020 19:40

Mathematics, 19.11.2020 19:40