Business, 07.04.2020 01:26 emmmmmily997

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bonds.

Bond A Bond B

Coupon rate 5.00% 5.00%

Time to maturity 5 years 25 years

Required return 7.37% 7.37%

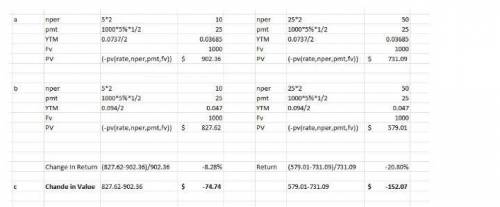

a. Calculate the values of Bond A and Bond B. (Round your answers to 2 decimal places.)

b. Recalculate the bonds’ values if the required rate of return changes to 9.40%. (Round your answers to 2 decimal places.)

c. Calculate the increase or decrease in bond value based on the change in required return. (Round your answers to 2 decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 15:10

You want to have $80,000 in your savings account 11 years from now, and you’re prepared to make equal annual deposits into the account at the end of each year. if the account pays 6.30 percent interest, what amount must you deposit each year? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 1

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 22:40

Rolston music company is considering the sale of a new sound board used in recording studios. the new board would sell for $27,200, and the company expects to sell 1,570 per year. the company currently sells 2,070 units of its existing model per year. if the new model is introduced, sales of the existing model will fall to 1,890 units per year. the old board retails for $23,100. variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,520,000 per year, and fixed costs are $1,420,000 per year.if the tax rate is 35 percent, what is the annual ocf for the project?

Answers: 1

You know the right answer?

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bon...

Questions

Mathematics, 17.12.2019 02:31

History, 17.12.2019 02:31

Mathematics, 17.12.2019 02:31

Mathematics, 17.12.2019 02:31

Mathematics, 17.12.2019 02:31