Business, 07.04.2020 21:32 beautifulnation3799

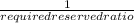

Suppose that the reserve requirement for checking deposits is 12.5 percent and that banks do not hold any excess reserves.

If the Fed sells $2 million of government bonds, the economy’s reserves Increase/Decrease bymillion, and the money supply will Increase/Decrease bymillion.

Now suppose the Fed lowers the reserve requirement to 10 percent, but banks choose to hold another 2.5 percent of deposits as excess reserves.

True or False: The money multiplier will remain unchanged.

a. True

b. False

True or False: As a result, the overall change in the money supply will remain unchanged.

a. True

b. False

Answers: 3

Another question on Business

Business, 21.06.2019 20:20

The 2016 financial statements of the new york times company reveal average shareholders’ equity attributable to controlling interest of $837,283 thousand, net operating profit after tax of $48,032 thousand, net income attributable to the new york times company of $29,068 thousand, and average net operating assets of $354,414 thousand. the company's return on net operating assets (rnoa) for the year is: select one: a. 3.5% b. 6.9% c. 13.6% d. 18.7% e. there is not enough information to calculate the ratio.

Answers: 1

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 03:00

Match the given situations to the type of risks that a business may face while taking credit.(there's not just one answer)1. beta ltd. had taken a loan from a bankfor a period of 15 years, but its salesare gradually showing a decline.2. alpha ltd. has taken a loan for increasing its production and sales,but it has not conducted any researchbefore making this decision.3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession.4. delphi ltd. has taken a short-term loanfrom the bank, but its supply chain logistics are not in place.a. foreign exchange riskb. operational riskc. term of loan riskd. revenue projections risk

Answers: 1

Business, 22.06.2019 11:50

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a.change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c.stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

You know the right answer?

Suppose that the reserve requirement for checking deposits is 12.5 percent and that banks do not hol...

Questions

Chemistry, 22.10.2020 20:01

Mathematics, 22.10.2020 20:01

Mathematics, 22.10.2020 20:01

Spanish, 22.10.2020 20:01

History, 22.10.2020 20:01

Health, 22.10.2020 20:01

History, 22.10.2020 20:01

Mathematics, 22.10.2020 20:01

History, 22.10.2020 20:01

History, 22.10.2020 20:01

=

=  = 8

= 8 = 8

= 8