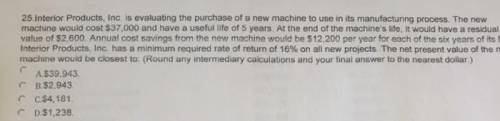

Interior Products, Inc. is evaluating the purchase of a new machine to use in its manufacturing process. The new machine would cost $ 37 comma 000 and have a useful life of 5 years. At the end of the machine's life, it would have a residual value of $ 2 comma 100. Annual cost savings from the new machine would be $ 12 comma 000 per year for each of the 5 years of its life. Interior Products, Inc. has a minimum required rate of return of 18% on all new projects. The net present value of the new machine would be closest toA $39,943. B.$52.943 C.$4,181 D.$1,238

Answers: 2

Another question on Business

Business, 22.06.2019 11:30

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

Business, 22.06.2019 20:50

Many potential buyers value high-quality used cars at the full-information market price of € p1 and lemons at € p2. a limited number of potential sellers value high-quality cars at € v1 ≤ p1 and lemons at € v2 ≤ p2. everyone is risk neutral. the share of lemons among all the used cars that might be potentially sold is € θ . suppose that the buyers incur a transaction cost of $200 to purchase a car. this transaction cost is the value of their time to find a car. what is the equilibrium? is it possible that no cars are sold

Answers: 2

Business, 22.06.2019 23:00

Which of the following is true of website content? it should be refreshed periodically to keep customers coming back. once the content has been written and proofread it shouldn't be changed. grammatical errors are not a problem because the customer visits the site to purchase a product, not check the site's grammar. it should be limited to text and shouldn't include multimedia.

Answers: 1

Business, 23.06.2019 07:50

Suppose that two countries, britain and the u.s. produce just one good - beef. suppose that the price of beef in the u.s. is $2.80 per pound, and in britain it is £3.70 per pound. according to ppp theory, what should the $/£ spot exchange rate be? suppose the price of beef is expected to rise to $3.10 in the u.s. and to £4.65 in britain. what should be the one year forward $/£ exchange rate?

Answers: 1

You know the right answer?

Interior Products, Inc. is evaluating the purchase of a new machine to use in its manufacturing proc...

Questions

Mathematics, 10.02.2021 21:20

French, 10.02.2021 21:20

Biology, 10.02.2021 21:20

English, 10.02.2021 21:20

History, 10.02.2021 21:20

English, 10.02.2021 21:20

Mathematics, 10.02.2021 21:20

Mathematics, 10.02.2021 21:20