Business, 08.04.2020 04:44 zamirareece17

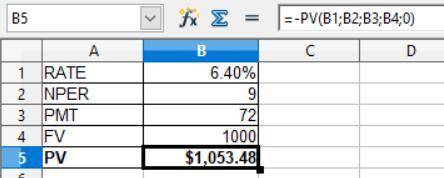

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $ 1 comma 000, and a coupon rate of 7.2 % (annual payments). The yield to maturity on this bond when it was issued was 6.4 %. Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment? Before the first coupon payment, the price of the bond is $ nothing. (Round to the nearest cent.)

Answers: 1

Another question on Business

Business, 21.06.2019 17:30

Consider the following two stocks, a and b. stock a has an expected return of 10%, 10% standard deviation, and a beta of 1.20. stock b has an expected return of 14%, 25% standard deviation, and a beta of 1.80. the expected market rate of return is 9% and the risk-free rate is 5%. security would be considered a good buy if we include the stock in a well diversified a portfolio because a. b, it offers better alpha b. a, it offers better alpha c. a, it offers better sharpe ratio d. b, it offers better sharpe ratio

Answers: 1

Business, 21.06.2019 18:10

Nestlé, a global food company headquartered in switzerland, provides its customers in each country with highly differentiated and customized products that fit the tastes and preferences of the local population. nestlé invests considerable resources in developing and maintaining a strong brand name that complements its high-quality product offerings across the globe. which of the following best fits nestlé's global strategy? 1. international strategy2. multi-domestic strategy3. global standardization strategy4. transnational strategy

Answers: 2

Business, 21.06.2019 22:30

Abusiness cycle reflects in economic activity, particularly real gdp. the stages of a business cycle

Answers: 2

You know the right answer?

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a fac...

Questions

Biology, 02.08.2019 09:10

Mathematics, 02.08.2019 09:10

Biology, 02.08.2019 09:10

Social Studies, 02.08.2019 09:10

Biology, 02.08.2019 09:10

Biology, 02.08.2019 09:10

History, 02.08.2019 09:10

History, 02.08.2019 09:10

Biology, 02.08.2019 09:10

History, 02.08.2019 09:10

History, 02.08.2019 09:10

Mathematics, 02.08.2019 09:10

Mathematics, 02.08.2019 09:10

Mathematics, 02.08.2019 09:10