Business, 10.04.2020 19:25 alexisgilford

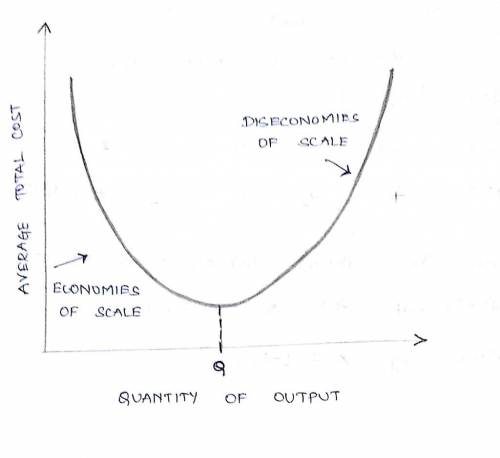

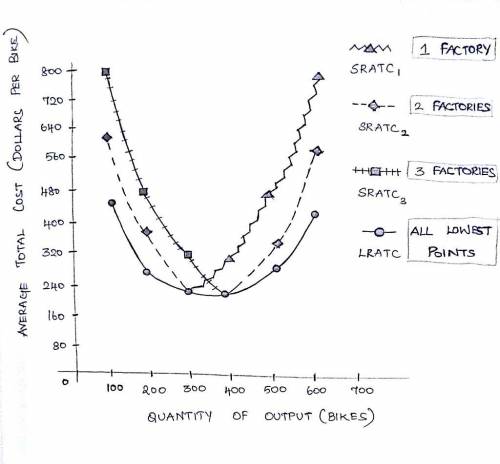

Costs in the short run versus in the long run Ike's Bikes is a major manufacturer of bicycles. Currently, the company produces bikes using only one factory. However, it is considering expanding production to two or even three factories. The following table shows the company's short-run average total cost (SRATC) each month for various levels of production if it uses one, two, or three factories. (Note: Q equals the total quantity of bikes produced by all factories.) Number of Factories Average Total Cost (Dollars per bike) Q = 100 Q = 200 Q = 300 Q = 400 Q = 500 Q = 600 1 440 280 240 320 480 800 2 620 380 240 240 380 620 3 800 480 320 240 280 440 Suppose Ike's Bikes is currently producing 600 bikes per month in its only factory. Its short-run average total cost isper bike. Suppose Ike's Bikes is expecting to produce 600 bikes per month for several years. In this case, in the long run, it would choose to produce bikes using . On the following graph, plot the three SRATC curves for Ike's Bikes from the previous table. Specifically, use the green points (triangle symbol) to plot its SRATC if it operates one factory ( ); use the purple points (diamond symbol) to plot its short-run average total cost if it operates two factories ( ); and use the orange points (square symbol) to plot its SRATC if it operates three factories ( ). Finally, plot the long-run average total cost (LRATC) for Ike's Bikes using the blue points (circle symbol). Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Suppose the number of firms you compete with has recently increased. you estimated that as a result of the increased competition, the demand elasticity has increased from –2 to –3 (i.e., you face more elastic demand). you are currently charging $10 for your product. what is the price that you should charge if demand elasticity is -3?

Answers: 3

Business, 22.06.2019 02:30

The cost of capital: introduction the cost of capital: introduction companies issue bonds, preferred stock, and common equity to aise capital to invest in capital budgeting projects. capital is』necessary factor of production and like any other factor, it has a cost. this cost is equal to the select the applicable security. the rates of return that investors require on bonds, preferred stocks, and common equity represent the costs of those securities to the firm. companies estimate the required returns on their securities, calculate a weighted average of the costs of their different types of capital, and use this average cost for capital budgeting purposes. required return on rate: when calculating om operations when the firm's primary financial objective is to select shareholder value. to do this, companies invest in projects that earnselect their cost of capital. so, the cost of capital is often referred to as the -select -select and accruals, which a se spontaneously we hted average cost of capital wa c our concern is with capital that must be provided by select- 쑤 interest-bearing debt preferred stock and common equity. capital budgeting projects are undertaken, are not included as part of total invested capital because they do not come directly from investors. which of the following would be included in the caculation of total invested capital? choose the response that is most correct a. notes payable b. taxes payable c retained earnings d. responses a and c would be included in the calculation of total invested capital. e. none of the above would be included in the cakulation of total invested capital.

Answers: 2

Business, 22.06.2019 16:10

Answer the following questions using the banker’s algorithm: a. illustrate that the system is in a safe state by demonstrating an order in which the processes may complete. b. if a request from process p1 arrives for (1, 1, 0, 0), can the request be granted immediately? c. if a request from process p

Answers: 1

Business, 22.06.2019 19:30

Exercise 4-9presented below is information related to martinez corp. for the year 2017.net sales $1,399,500 write-off of inventory due to obsolescence $80,440cost of goods sold 788,200 depreciation expense omitted by accident in 2016 43,600selling expenses 65,800 casualty loss 53,900administrative expenses 53,500 cash dividends declared 43,300dividend revenue 22,100 retained earnings at december 31, 2016 1,042,400interest revenue 7,420 effective tax rate of 34% on all items exercise 4-9 presented below is information relateexercise 4-9 presented below is information relate prepare a multiple-step income statement for 2017. assume that 61,500 shares of common stock are outstanding. (round earnings per share to 2 decimal places, e.g. 1.49.)prepare a separate retained earnings statement for 2017. (list items that increase retained earnings first.)

Answers: 2

You know the right answer?

Costs in the short run versus in the long run Ike's Bikes is a major manufacturer of bicycles. Curre...

Questions

Mathematics, 06.03.2020 07:17

Biology, 06.03.2020 07:18

World Languages, 06.03.2020 07:18

Mathematics, 06.03.2020 07:19