Business, 14.04.2020 22:01 aeshaalhemri

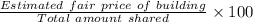

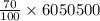

PNW, LLC purchased equipment, a building, and land for one price of $6,050,500. The estimated fair values of the equipment, building, and land are $1,000,000, $7,000,000, and $2,000,000, respectively. At what amount would the company record the building?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

1. gdp is calculated by summing consumption, investment, and exports of all final goods and services produced within the borders of a given country during a specific period the dollar value of all final goods and services produced within the borders of a given country during a specific period government expenditures within the borders of a given country during a specific period the quantity of all final goods and services produced within the borders of a given country during a specific period

Answers: 3

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

Business, 22.06.2019 15:40

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

You know the right answer?

PNW, LLC purchased equipment, a building, and land for one price of $6,050,500. The estimated fair v...

Questions

Physics, 18.10.2021 02:20

Geography, 18.10.2021 02:20

English, 18.10.2021 02:20

Chemistry, 18.10.2021 02:20

Biology, 18.10.2021 02:20

Mathematics, 18.10.2021 02:20

Mathematics, 18.10.2021 02:20

English, 18.10.2021 02:30

Mathematics, 18.10.2021 02:30

Advanced Placement (AP), 18.10.2021 02:30

Mathematics, 18.10.2021 02:30

.

.