Business, 14.04.2020 22:21 jjortiz3137

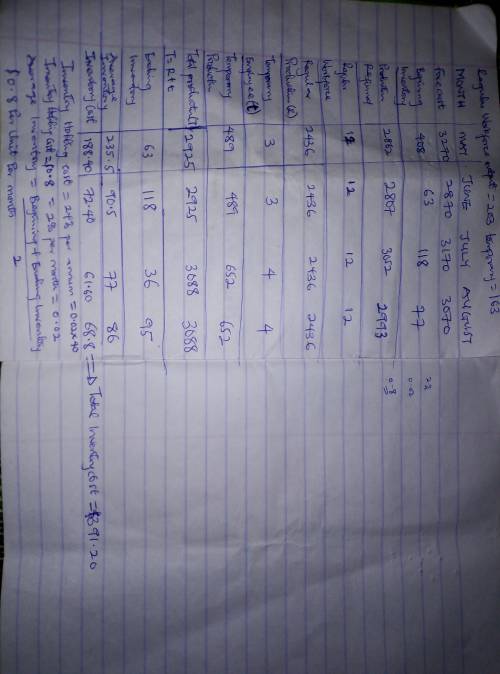

Helter Industries, a company that produces a line of women's bathing suits, hires temporaries to help produce its summer product demand. For the current four-month rolling schedule, there are 12 full-time employees on staff. Temps can be hired when needed and can be used as needed on a month-by-month basis, whereas the full-time employees must be paid whether they are needed or not. Each full-time employee can produce 203 suits, while each temporary employee can produce 163 suits per month. Demand for bathing suits for the next four months is as follows: MAY JUNE JULY AUGUST 3,270 2,870 3,170 3,070 Beginning inventory in May is 408 complete (a complete two-piece includes both top and bottom) bathing suits. Bathing suits cost $40 to produce and carrying cost is 36 percent per year. Develop an aggregate plan that uses the 12 full-time employees each month and a minimum number of temporary employees. Assume that all employees will produce at their full potential each month. Calculate the inventory carrying cost associated with your plan using planned end of month levels.

Answers: 2

Another question on Business

Business, 21.06.2019 17:10

Four analysts cover the stock of fluorine chemical. one forecasts a 6% return for the coming year. the second expects the return to be negative 6%. the third predicts a return of 8%. the fourth expects a 2% return in the coming year. you are relatively confident that the return will be positive but not large, so you arbitrarily assign probabilities of being correct of 35 % comma 8 %, 17 %, and 40%, respectively, to the analysts' forecasts. given these probabilities, what is fluorine chemicals expected return for the coming year

Answers: 3

Business, 21.06.2019 21:30

Problem 2-18 job-order costing for a service company [lo2-1, lo2-2, lo2-3]speedy auto repairs uses a job-order costing system. the company's direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics' hourly wages. speedy's overhead costs include various items, such as the shop manager's salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. the company applies all of its overhead costs to jobs based on direct labor-hours. at the beginning of the year, it made the following estimates: direct labor-hours required to support estimated output 10,000fixed overhead cost $ 90,000variable overhead cost per direct labor-hour $ 1.00 required: 1. compute the predetermined overhead rate.2. during the year, mr. wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. the following information was available with respect to his job: direct materials $ 600direct labor cost $ 180direct labor-hours used 2 compute mr. wilkes' total job cost. 3. if speedy establishes its selling prices using a markup percentage of 30% of its total job cost, then how much would it have charged mr. wilkes?

Answers: 1

Business, 22.06.2019 10:00

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

You know the right answer?

Helter Industries, a company that produces a line of women's bathing suits, hires temporaries to hel...

Questions

Mathematics, 30.09.2019 15:50

Mathematics, 30.09.2019 15:50

Biology, 30.09.2019 15:50

Social Studies, 30.09.2019 15:50

Business, 30.09.2019 15:50

Mathematics, 30.09.2019 15:50

History, 30.09.2019 15:50

History, 30.09.2019 15:50

History, 30.09.2019 15:50

English, 30.09.2019 15:50