Business, 15.04.2020 15:32 Madalyngarcia20

1.Lionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $24,000 from County Bank and paid interest of $1,440. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for higher education expenses and interest on higher education loans under the following circumstances:

Lionel's AGI before deducting interest on higher education loans is $74,000.

(1) Modified AGI $ 74,000

(2) Amount of interest paid up to $2,500 1,440 Lesser of amount paid or $2,500

(3) Phase-out (reduction) percentage 60 % [(1) − 65,000]/15,000,limited to 100 percent

(4) Phase-out amount (reduction in maximum) 864 (2) × (3)

Deductible interest expense $ 576 (2) − (4)

2.This year Jack intends to file a married-joint return with two dependents. Jack received $162,500 of salary and paid $5,000 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid qualified moving expenses of $4,300 and $24,000 of alimony.

What is Jack's adjusted gross income? Assume that Jack will opt to treat tax items in a manner to minimize his AGI.

AGI is $132,050. Jack's modified AGI calculated without adjustment for educational interest expense is 134,200. He is allowed to deduct part of his student loan interest because his modified AGI is not above $160,000. Jack's maximum deduction before the phase-out is $2,500 (the amount of interest paid up to $2,500). The maximum deduction of $2,500 is phased-out ratably over a $30,000 range beginning with modified AGI over $130,000. Consequently, Jack’s education interest expense deduction is $2,150 = ($2,500 − $2,500 × [($134,200 − 130,000)/30,000]). Jack’s AGI is computed as follows;

Salary and gross income $ 162,500

Less: Alimony – 24,000

Moving expense deduction – 4,300

Modified AGI $ 134,200

Student loan interest deduction – 2,150

AGI $ 132,050

my question:

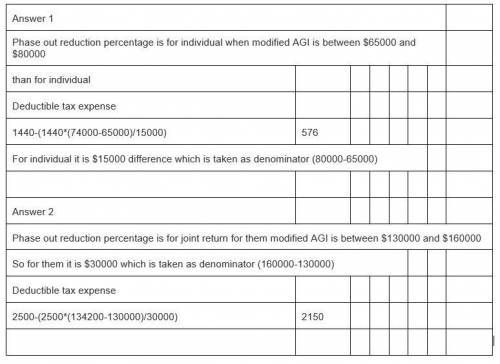

On Question 1 : [(1) − 65,000]/15,000,limited to 100 percent

On Question 2: ($2,500 − $2,500 × [($134,200 − 130,000)/30,000])

Why 15,000 on question 1 , compared to 30,000 on question 2?

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

How did the contribution of the goods producing sector to gdp growth change between 2010 and 2011 a. it fell by 0.3%. b. it fell by 2.3%. c. it rose by 2.3%. d. it rose by 0.6%. the answer is b

Answers: 1

Business, 22.06.2019 17:10

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

Business, 22.06.2019 20:20

As you have noticed, the demand for flip phones has drastically reduced, and there are only a few consumer electronics companies selling them at extremely low prices. also, the current buyers of flip phones are mainly categorized under laggards. which of the following stages of the industry life cycle is the flip phone industry in currently? a. growth stage b. maturity stage c. decline stage d. commercialization stage

Answers: 2

Business, 22.06.2019 21:00

Adecision is made at the margin when each alternative considers

Answers: 3

You know the right answer?

1.Lionel is an unmarried law student at State University Law School, a qualified educational institu...

Questions

Mathematics, 17.04.2020 10:18

Mathematics, 17.04.2020 10:18

History, 17.04.2020 10:18

Spanish, 17.04.2020 10:18

English, 17.04.2020 10:18

Chemistry, 17.04.2020 10:18

Mathematics, 17.04.2020 10:18

Engineering, 17.04.2020 10:18

Mathematics, 17.04.2020 10:18