Business, 15.04.2020 21:46 xgibson123

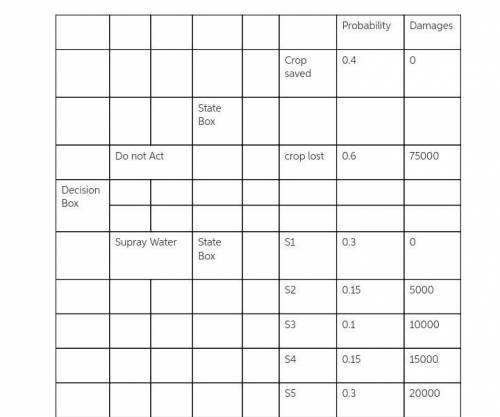

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the event that the overnight temperature falls to a level well below freezing. If the temperature drops too low, he runs the risk of losing his entire crop, valued at $75,000. Based on the National Weather Service, the probability of such a temperature drop is 60%. He can insulate his crop by spraying water on all the trees, which will cost $20,000. This action might succeed in protecting the crop, with the following possible outcomes. Probability Damage 0.30 $0 0.15 $5,000 0.10 $10,000 0.15 $15,000 0.30 $20,000 Refer to the scenario.

(A) Construct a decision tree to help the farmer make his decision.

(B) What should he do? Explain your answer.

(C) Refer to the scenario. Find the highest cost of insulating the grapefruits for which the farmer prefers to insulate his crop.

(D) Refer to the scenario. Suppose the farmer is uncertain about the reliability of the National Weather Service forecast. If he thinks the probability of a freeze occurring could be anywhere between 40% and 80%, would that change his decision?

(E) Refer to the scenario. Suppose that, in addition to the uncertainty about the probability of freezing, he is also uncertain about the cost of the insulation (could vary from $10,000 to $30,000). To which of these variables is the expected value most sensitive?

(F) Refer to the scenario. Suppose the farmer is not risk-neutral, but instead his behavior can be modeled using an exponential utility function with a risk tolerance parameter of 100,000. What is the most he would be willing to pay for insulation in that case?

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 14:30

In our daily interactions we can find ourselves listening to other people solely for the purpose of finding weakness in their positions so that we can formulate a convincing response. select one: true false

Answers: 1

Business, 22.06.2019 23:10

R& m chatelaine is one of the largest tax-preparation firms in the united states. it wants to acquire the tax experts, a smaller rival. after the merger, chatelaine will be one of the two largest income-tax preparers in the u.s. market. what should chatelaine include in its acquisition plans? it should refocus its attention from the national to the international market. in addition to acquiring the tax experts, it should also determine the best way to drive independent "mom and pop" tax preparers out of business. chatelaine will need to explain to the federal trade commission how the acquisition will not result in an increase in prices for consumers. chatelaine should enter a price-based competition with its other major competitor to force it out of business and become a monopoly.

Answers: 3

You know the right answer?

A farmer must decide whether to take protective action to limit damage to his grapefruit crop in the...

Questions

Computers and Technology, 24.04.2020 20:08

Biology, 24.04.2020 20:08

Mathematics, 24.04.2020 20:08

Social Studies, 24.04.2020 20:08

Mathematics, 24.04.2020 20:08

Social Studies, 24.04.2020 20:08

History, 24.04.2020 20:09