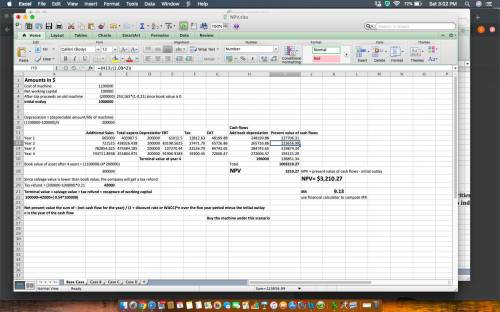

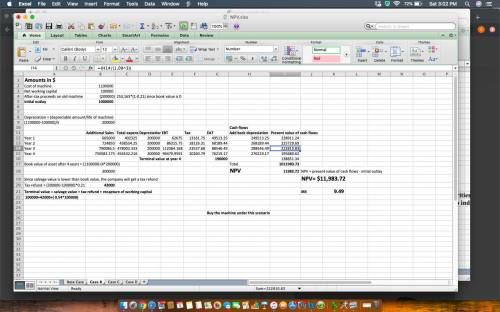

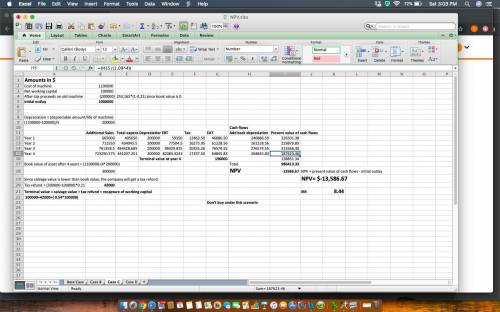

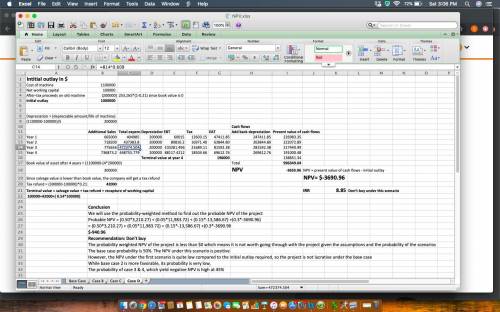

Mid-Michigan Manufacturing Inc. (MMMI) wishes to determine whether it would be advisable to replace an existing production machine with a new one. The have hired your firm as a consultant to determine whether the new machine should be purchased. The data you will need to make this determination is as follows:

MMMI has decided to set a project timeline of 4 years.

The new machine will cost $1,100,000. It will be depreciated (straight line) over a five-year period (its estimated useful life), assuming a salvage value of $100,000.

The old machine, which has been fully depreciated, could be sold today for $253,165. The company has received a firm offer for the machine from Williamston Widgets, and will sell it only if they purchase the new machine.

Additional Sales generated by the superior products made by the new machine would be $665,000 in Year 1. In Years 2 & 3 sales are projected to grow by 8.5% per year. However, in Year 4, sales are expected to decline by 5% as the market starts to become saturated.

Total expenses have been estimated at 60.75% of Sales.

The firm is in the 21% marginal tax bracket and requires a minimum return on the replacement decision of 9%.

A representative from Stockbridge Sprockets has told MMMI that they will buy the machine from them at the end of the project (the end of Year 4) for $100,000. MMMI has decided to include this in the terminal value of the project.

The project will require $100,000 in Net Working Capital, 54% of which will be recovered at the end of the project.

1. Calculate the Operating Cash Flow per year and NPV.

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Excellent inc. had a per-unit conversion cost of $3.00 during april and incurred direct materials cost of $112,000, direct labor costs of $84,000, and manufacturing overhead costs of $50,400 during the month. how many units did it manufacture during the month? a. 18,000 b. 44,800 c. 70,000 d. 30,000

Answers: 1

Business, 21.06.2019 20:30

Which of the following best describes a fractional reserve banking system? a. a banking system in which a large portion of the bank's assets are digital money rather than bills and coins. b. a banking system in which banks keep a portion of deposits on hand to satisfy their customer's demands for withdrawals. c. a banking system in which banks have only partial control over the interest rates they charge on loans. d. a banking system in which net worth is calculated by subtracting a fraction of liabilities from assets. 2b2t

Answers: 3

Business, 22.06.2019 22:10

Which of the following is usually not one of the top considerations in choosing a country for a facility location? a. availability of labor and labor productivityb. attitude of governmental unitsc. location of marketsd. zoning regulationse. exchange rates

Answers: 1

Business, 22.06.2019 22:30

Ski powder resort ends its fiscal year on april 30. the business adjusts its accounts monthly, but closes them only at year-end (april 30). the resort's busy season is from december 1 through march 31. adrian pride, the resort's chief financial officer, the museums a close watch on lift ticket revenue and cash. the balances of these accounts at the end of each of the last five months are as follows:

Answers: 3

You know the right answer?

Mid-Michigan Manufacturing Inc. (MMMI) wishes to determine whether it would be advisable to replace...

Questions

Mathematics, 29.08.2021 20:20

Social Studies, 29.08.2021 20:20

Mathematics, 29.08.2021 20:20

World Languages, 29.08.2021 20:20

Mathematics, 29.08.2021 20:20

Social Studies, 29.08.2021 20:20

History, 29.08.2021 20:20

Mathematics, 29.08.2021 20:20

Social Studies, 29.08.2021 20:20

Social Studies, 29.08.2021 20:20

Engineering, 29.08.2021 20:20

Mathematics, 29.08.2021 20:20