Business, 16.04.2020 00:25 jagdeep5533

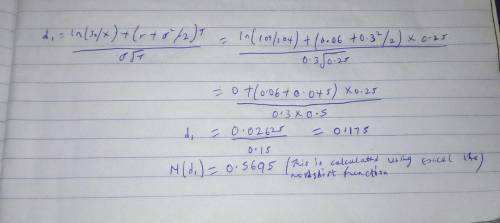

Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $104 are selling at an implied volatility of 28%. ExxonMobil stock currently is $104 per share, and the risk-free rate is 6%. If you believe the true volatility of the stock is 30%. a. If you believe the true volatility of the stock is 30%, would you want to buy or sell call options? Buy call options Sell call options b. Now you need to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold? (Round your answer to 4 decimal places.)

Answers: 2

Another question on Business

Business, 21.06.2019 21:40

Torino company has 1,300 shares of $50 par value, 6.0% cumulative and nonparticipating preferred stock and 13,000 shares of $10 par value common stock outstanding. the company paid total cash dividends of $3,500 in its first year of operation. the cash dividend that must be paid to preferred stockholders in the second year before any dividend is paid to common stockholders is:

Answers: 2

Business, 22.06.2019 08:30

Most angel investors expect a return on investment of question options: 20% to 25% over 5 years. 15% to 20% over 5 years. 75% over 10 years. 100% over 5 years.

Answers: 1

Business, 22.06.2019 09:00

Your grandmother told you a dollar doesn't go as far as it used to. she says the purchasing power of a dollar is much lesser than it used to be. explain what she means. try and use and explain terms like inflation and deflation in your answer.

Answers: 1

Business, 22.06.2019 15:40

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

You know the right answer?

Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $104...

Questions

Mathematics, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00

Geography, 29.07.2021 14:00

Biology, 29.07.2021 14:00

English, 29.07.2021 14:00

Physics, 29.07.2021 14:00

English, 29.07.2021 14:00

English, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00

Mathematics, 29.07.2021 14:00