Business, 16.04.2020 00:48 brinleychristofferse

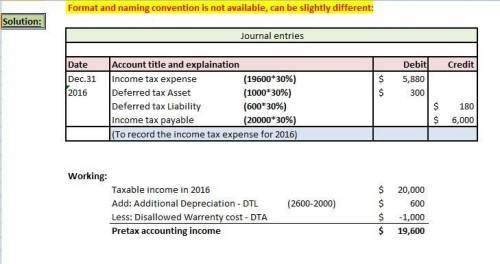

Simpson Inc. had a balance in the Deferred Tax Liability account of $420 on December 31, 2015, resulting from depreciation temporary differences. Differences in tax and accounting depreciation for assets purchased on January 1, 2015 is as follows: YEAR FINANCIAL DEPRECIATION TAX DEPRECIATION 2015 $2,000 $3,400 2016 $2,000 2,600 2017 $2,000 1,200 2018 $2,000 800 $8,000 $8,000 In addition to the 2016 depreciation temporary difference, Simpson expensed $1,000 of warranty costs that will be deducted for tax purposes when paid in future years. Simpson’s taxable income in 2016 was $20,000. The 2016 income tax rate was 30% and no change in tax rate for future years have been enacted. REQUIRED: Prepare the income tax journal entry for Simpson Inc. for December 31, 2016.

Answers: 2

Another question on Business

Business, 21.06.2019 14:50

Answer the following questions with true or false and provide a brief explanation (2- 3 sentences) a) economies of scale in production give rise to multi-product firms. b) ace hardware corporation is an example of economies of scale in production.

Answers: 3

Business, 21.06.2019 20:30

Partnerships are the most common type of business firms in the world. t/f

Answers: 3

Business, 22.06.2019 09:30

Any point on a country's production possibilities frontier represents a combination of two goods that an economy:

Answers: 3

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

You know the right answer?

Simpson Inc. had a balance in the Deferred Tax Liability account of $420 on December 31, 2015, resul...

Questions

Mathematics, 04.08.2021 03:40

Computers and Technology, 04.08.2021 03:40

Mathematics, 04.08.2021 03:40

Geography, 04.08.2021 03:40

Mathematics, 04.08.2021 03:40

Mathematics, 04.08.2021 03:40

Computers and Technology, 04.08.2021 03:40

Mathematics, 04.08.2021 03:40